Investment Tips - Burgundy - 30. January 2025

Investing in the Legendary Leroy

From Musigny to Narbantons – iconic wines crafted by Leroy herself. We repeat: Buy while you still can.

"Natural wine is complete nonsense, of course it's natural. If one lets the wine make itself, it won't be any good. A wine still requires care. [...] I certainly don’t see myself as a champion, I’m an apprentice, somewhat studious, very studious actually. And every year I learn something."

– Lalou Bize-Leroy

The above words come from a both humble and confident Lalou Bize-Leroy in a 2023 interview with the consulting firm Winelister. And in reality, they frame this investment opportunity perfectly. At the age of 91, Leroy still saw herself as an apprentice—despite long since achieving the cult status every winemaker dreams of, even while still actively working. She also indirectly reveals that her wines are the result of the meticulous care she dedicates to her vines.

Now nearing 93, Madame Leroy remains active in both vineyard and cellar. But the day will come when she steps back, when her wines will no longer benefit from her hands-on care, and that responsibility will pass to others. What the future holds, we do not know. But right now, you have the opportunity to invest in wines born of Leroy’s curiosity. And her care.

Madame Lalou Bize-Leroy – The Queen of Burgundy

Lalou Bize-Leroy is a living legend and one of the most influential figures in Burgundy. Known as the "Queen of Burgundy," she has shaped the wine world for decades through both Domaine de la Romanée-Conti and her own estates, with an uncompromising dedication to perfection. Her wines are among the rarest and most sought-after in the world.

Today, she leads three companies: Maison Leroy, a négociant business that sources only the finest grapes; Domaine Leroy, which owns 23 hectares of Burgundy’s most exclusive vineyards; and Domaine d’Auvenay, her private micro-domaine spanning just four hectares. All three are run according to strict biodynamic principles, where nature’s rhythms dictate production.

Her legacy is undeniable, and her wines stand as benchmarks in Burgundy – not just as investment assets, but as true works of liquid art.

Price Correction and Power 100 Ranking

The strongest argument for investing in Leroy is, of course, that these wines are produced by one of the most important winemakers in history and that Leroy is one of the world's most prestigious wine brands. But another compelling reason is that Leroy’s wines have undergone significant price corrections in recent years. And this trend is not unique to Leroy.

All major Liv-ex indices have declined by at least 9% in 2024 compared to the previous year, even though trading activity has remained high. Leroy’s strong position on the Liv-ex Power 100 ranking remains intact, improving from #10 in 2023 to #9 in 2024. This ranking reflects 12 months of global market trading and considers factors such as price performance, average price, and both value and volume traded on Liv-ex.

There is no doubt that the Leroy brand remains highly sought after. And precisely because the market has been challenging in recent years, some truly unique buying opportunities are now available.

Invest at a Lower Cost Than Direct Domain Access

Prices on the secondary market have adjusted to the point where you can currently invest at a lower price than direct releases from the domain – if, of course, you were privileged enough to have access.

Late releases directly from the domain undoubtedly hold great value, and there is no risk of Domaine Leroy sitting on excess stock –far from it. However, this situation presents a rare opportunity to capitalize on market conditions and secure Leroy wines at a price significantly lower than new late releases from the estate’s own cellar. That’s exciting.

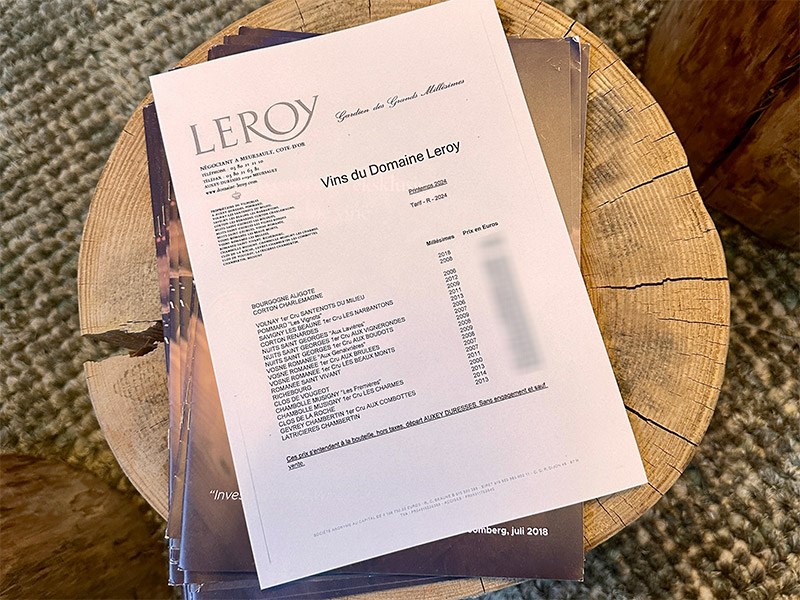

We have secured the following wines from Domaine Leroy, now available for investment:

2011 Domaine Leroy Musigny

Musigny has achieved mythical status among wine lovers and collectors due to its small size, extreme quality, and the limited quantities produced each year. The combination of historical prestige, world-class terroir, and the most talented producers makes it one of the most sought-after wines in the world. And when the label reads Leroy, it simply doesn’t get any greater.

When it comes to Leroy Musigny, the key question is whether you can even secure a bottle. With just 0.27 hectares on this legendary vineyard, Leroy is allowed to produce a maximum of 1,350 bottles, but the yield for the 2011 vintage was only 892 bottles.

The 2011 Leroy Musigny has been awarded 98 points by Burghound, 95 points by Wine Advocate, and has not been rated by Vinous.

Burghound suggests enjoying it from 2030 onwards, while Wine Advocate has not provided a specific drinking window for the 2011 vintage. However, they note that the 2010 vintage should be enjoyed before 2045, and the 2015 vintage is expected to age until 2070 (WA).

The valuation of this 2011 Leroy Musigny has previously been higher. Just a year ago, it was valued at €45,000, while today, your price is €32,500*. Additionally, the lowest current offer for the 2011 Leroy Musigny on wine-searcher.com is €38,732*. There are only six full-case offers listed in the database (eight in total, including two single loose bottles).

Leroy’s Musigny is one of the greatest treasures of the wine world—a wine that exudes sheer opulence. And hence, its price.

*Price excludes duties, VAT, and taxes. Offered in original wooden case (OWC) and in perfect condition.

Price: €32,500

Packaging: OWC3

Total production: 892 bottles

Note: Only one case available

2015 Domaine Leroy Nuits Saint Georges Rouge

Domaine Leroy produces a Nuits Saint Georges Rouges Village—crafted from meticulously selected parcels. This 2015 Nuits Saint Georges originates from Leroy’s 0.52-hectare Aux Allots parcel, 0.69 hectares on Aux Lavières, and 0.15 hectares on Bas de Combe. As always, biodynamic practices play a crucial role, including green harvesting (thinning of grape clusters), which reduces the number of bunches per vine to achieve maximum concentration in the remaining grapes. As a result, Leroy’s yields are exceptionally low, even at the village level, with only 3,318 bottles produced in 2015.

Burghound awards 90 points, Wine Advocate 92 points and Vinous 92 points.

This wine has also been subject to price correction. In May 2023, the 2015 Leroy Nuits Saint Georges Rouge was valued at €4,500*. Your price today is €3,150*, while the lowest current offer on wine-searcher.com stands at €3,962*.

Wine Advocate drinking window: 2023–2045

Note: The 2015 vintage is a benchmark year in Burgundy.

Price: €3,150

Packaging: OWC6

Total production: 3,318 bottles

Availability: Only one case available

*Price excludes duties, VAT, and taxes. Offered in original wooden case (OWC) and in perfect condition.

2015 Domaine Leroy Savigny Beaune Narbantons

"Les Narbantons" is one of the most renowned Premier Cru vineyards in Savigny-lès-Beaune, a commune in the Côte de Beaune region of Burgundy. Situated near the Beaune border, this vineyard has a distinct character compared to the more northern sites in Savigny. This wine is one of the most exclusive and sought-after Premier Cru wines from the area. The vineyard spans approximately 7.5 hectares, of which Leroy holds a scarce 0.81 hectares.

This limited holding means the domaine is legally allowed to produce a maximum of 4,860 bottles per vintage, though the actual yield from Leroy is likely significantly lower. Even if she were to maximize production, fewer than 5,000 bottles would be far from enough to satisfy the ever-hungry market for Leroy wines. With a drinking window of 2023–2045 (Wine Advocate), this is a wine to cellar and let time further reduce its already limited availability.

Just a year and a half ago, the 2015 Leroy Savigny Beaune Narbantons was valued at €4,500*. Your price today is €3,500*.

Note: The 2015 vintage is a benchmark year in Burgundy.

*Price excludes duties, VAT, and taxes. Offered in original wooden case (OWC) and in perfect condition.

Price: €3,500

Packaging: OWC3

Note: Only one case available

2011 Domaine Leroy Pommard Vignots

Pommard "Les Vignots" is one of the most intriguing and underrated Village vineyards in Pommard, Côte de Beaune. However, when a village wine bears the Leroy name, demand is inherent—underrated or not. The 2011 Leroy Pommard Vignots has received 89 points from Burghound, 90 points from Wine Advocate, and has not been rated by Vinous.

Leroy produces Pommard Vignots from just 1.26 hectares, resulting in an exceptionally small production of only 4,722 bottles in the 2011 vintage. Your price is €2,000*, while the lowest current listing on wine-searcher.com stands at €2,532*.

*Price excludes duties, VAT, and taxes. Offered in original wooden case (OWC) and in perfect condition.

Price: €2,000

Packaging: OWC6

Total production: 4,722 bottles

Note: Only one case available

2011 Domaine Leroy Vosne Romanee Beaumonts

In the heart of Vosne-Romanée, just north of the legendary Richebourg vineyard and west of Échézeaux, lies Les Beaux Monts—a site that has even been shaped by the iconic Henri Jayer. This Premier Cru vineyard is divided into four sections, with Domaine Leroy owning the largest share at 2.61 hectares.

Many consider Les Beaux Monts to be the finest Premier Cru in all of Vosne-Romanée. It enjoys immense prestige among wine lovers worldwide, and with a price point that remains in a different league than Leroy’s most exclusive wines, demand is insatiable.

Domaine Leroy’s Les Beaux Monts is nothing short of a rare gem from Vosne-Romanée. Production is highly limited, with only 3,920 bottles produced in the 2011 vintage.

The 2011 Leroy Les Beaux Monts was awarded 95 points by Burghound and 94 points by Wine Advocate, while Vinous has yet to score it. This is also one of the Leroy wines that has undergone significant price corrections. In February 2023, it was valued at €5,750*, while today, your price is €3,250*. The lowest listing on wine-searcher.com currently stands at €3,747*. Despite the recent decline, the price has still increased 13% per year since we first offered it for investment in February 2020.

The drinking window is expected to open in 2028 and extend until 2048, allowing ample time for the market to regain its strength while available quantities diminish further.

*Price excludes duties, VAT, and taxes. Offered in original wooden case (OWC) and in perfect condition.

Price: €3,150

Packaging: OWC6

Total production: 3,920 bottles

Note: Only one case available

RareWine Invest’s Opinion

The day Lalou Bize-Leroy steps down from the throne at Domaine Leroy, the estate will undoubtedly remain one of the most powerful wine producers in the world. However, for true wine lovers, there will forever be a distinction between a bottle crafted under her meticulous hands and one made without her direct influence.

The vintages listed above represent her craftsmanship, her passion, her magic, and her relentless pursuit of perfection. These wines are still young, making them an ideal choice for long-term cellaring, ensuring that future generations of wine lovers—those who can afford it, those lucky enough to acquire a bottle—can also experience the magic.

Regardless of classification or vineyard, Leroy creates world-class wines. Leroy is the epitome of extreme scarcity and overwhelming demand, and today, prices are significantly lower than what we saw just two years ago.

The market has a history of recovering its strength. If you believe Leroy’s prices will return to their former glory, then with an investment in any of the above options, you are already ahead. We would have offered these wines for investment even if prices had remained at their 2023 levels. These bottles are young. Leroy is unmatched. Quantities are minuscule.

Note: Only a very limited number of cases are available, making this a first-come, first-served opportunity.