Market Analysis - 17. September 2024

The correlation between wine prices and interest rates: Is it time to buy up in wine?

Interest rates are a hot topic, but how do they affect wine prices? We have looked into it, and there are signs that it might be time to stock up. Decide for yourself.

Investing in wine has historically been an attractive asset; in specific categories, it has even outperformed stocks. In 2023, for example, we were able to divest 1,333 positions for investors, with an average return of 46% over an average holding period of 30 months. Despite this, it is no secret that the wine market has faced headwinds recently, and some categories have experienced corrections. But has the market bottomed out, and is it time to start buying again?

We have analyzed the link between wine price trends and interest rates, and the results suggest that exciting times may be ahead for wine investors.

Insights On Correlations

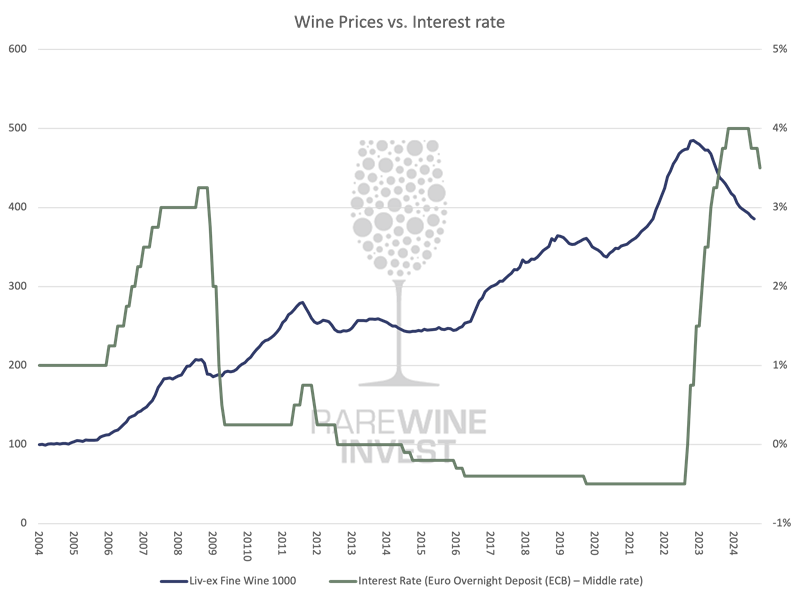

From 2004 (the starting point for the first valid data on ‘fine wine’ prices, Liv-ex) to the present, we have seen several periods of positive correlation between wine prices and interest rates.

For example, the correlation was particularly strong in 2006 and 2007, with values exceeding 0.85.*

Over the same 20-year period, there have been years of negative correlations, where wine prices and interest rates moved in opposite directions. This was especially pronounced in 2016 and 2023, with correlations below -0.9.

The above suggests that there have been periods when market dynamics affecting both wine investments and interest rates were likely aligned. For instance, budding economic growth positively impacted wine prices but had not yet influenced inflation levels.

Conversely, periods of negative correlation resulted in environments where rising interest rates dampened investor appetite—for traditional assets as well as wine.

*The strength of a correlation is measured in a value from -1 to 1 where -1 means that there is no correlation between the two variables, while a value of 1 means that there is a strong correlation.

Trends In the Bigger Picture

In this context, the period from 2004 to today can be divided into three phases: (1) the financial crisis and the upswing leading up to it, (2) the post-crisis recovery, including the COVID crisis, and (3) the period from 2022 onward, marked by the energy crisis, inflation crisis, and war in Europe and the Middle East.

During the upswing before the financial crisis, wine and interest rates were positively correlated, with wine prices likely driven by the generally positive market sentiment. When the financial crisis hit and interest rates plummeted between 2008-2010, wine prices rose, resulting in a negative correlation of -0.44. In this phase, wine became a "safe haven" for investors and performed well amidst the economic turmoil.

From 2016, global markets showed an overall optimistic sentiment, and the economy flourished despite events like Brexit and trade wars. Interest rates fell to historically low levels, and wine prices rose. Other market factors naturally played a role, but nonetheless, there was a strong negative correlation of -0.66, indicating a strong inverse relationship between these variables.

Now, things get interesting. In November 2022, wine prices peaked, and the trend turned negative as liquidity vanished from the market. A significant explanation for this may be the sharp rise in interest rates starting around May 2022 in response to rapidly increasing inflation. From May 2022 to today, there has been a negative correlation of -0.76 between wine prices and interest rates, meaning a statistical relationship exists between rising interest rates and declining wine prices.

So What?

In periods when interest rates have been lowered or remained low, wine prices have trended upward. This suggests that lower interest rates often lead to increased trading activity, demand, liquidity, and ultimately rising prices.

After years of a hostile interest rate environment, it finally appears that leading central banks are easing their grip. As recently as September 12 of this year, the European Central Bank (ECB) lowered rates by 0.25 basis points, and there is also consensus in the market that the U.S. Federal Reserve (FED) will similarly cut rates by at least 0.25 basis points at its next meeting on September 18.

RareWine Invest Believes

It is not new that an attractive interest rate environment would positively impact wine prices; the above correlation analysis merely supports this thesis.

However, many factors impact price developments, and as the wine market is global, the economic conditions in key markets (Europe, the U.S., and China) are also crucial. Economic weakness in these regions can dampen the positive effects that wine investors might expect from rate cuts.

That said, we currently see solid buying opportunities, and corrections in various categories have created attractive opportunities not seen in years. Like stocks, it is impossible to predict when we will hit the bottom for wine prices this time. However, we are noticing that more and more wines seem to have reached a sort of support level. Other wines in the most exclusive categories have dropped so much in price that they realistically should not be able to fall further. This is simply because the bottles are a physical product that will always represent a particular value—and as such, they are more often taken off the market and sold at more lucrative times if conditions aren’t attractive.

The message is quite simple: Historically, wine prices have risen when interest rates have fallen or remained low. The ECB has lowered rates twice in 10 months, and the wine market is filled with attractive buying opportunities we haven’t seen in years.

For those with an appetite for investment, all data indicates that new investors can now take advantage of a few tough years in the wine market, buy in at attractive prices, and enjoy lucrative market conditions if the trend of falling interest rates continues over the next few years.