Investment Tips - Champagne - 12. June 2024

Invest In 2012 Dom Pérignon: One Of The Greatest

With a correction in mind and strong historical returns, the timing for investing seems attractive.

2012 Dom Pérignon

Start your wine investment with 2012 Dom Pérignon - or add it to your portfolio

Now you can start investing in wine with one of the greatest icons of Champagne, Dom Pérignon, and from a great vintage. We have analysed the investment case and outlined three reasons why we think 2012 Dom Pérignon is an attractive investment, which you can read below.

If you are not yet an investor, you can easily get started via the box below.

Three Good Reasons To Invest In 2012 Dom Perignon

1: Great Champagne

With an investment in Dom Pérignon, you are not just investing in some of the best and most coveted Champagne. No, an investment in Dom Pérignon is an investment in an icon, in one of the wine world's greatest brands and in a luxury conglomerate called Louis Vuitton Moët Hennessy Group, one of the world's largest players in the luxury segment and a specialist in positioning this type of product.

It is also not a new phenomenon that great Champagnes offer good returns. According to the UK wine exchange Liv-ex's Champagne Index, which tracks the prices of the greatest and most traded Champagnes (including Dom Pérignon), if you had invested in Champagne 20 years ago, you would have got your money back 5.5x. For reference. In comparison, being invested in the S&P 500 would have ‘only’ yielded a return of 374.6%.

2: Returns And Timing

Dom Pérignon has historically been a good investment. Over the past five years, the last 10 vintages that have been on the market for the entire period* have yielded an average return of 59.9% according to Liv-ex. This corresponds to an average annual return of 9.8%.

This is a solid return in itself, but it also includes a significant correction that has hit the Champagne market in particular over the past 1.5 years or so. A correction primarily triggered by the effects of macroeconomic turmoil and war in Europe. Since the peak in October 2022, the Champagne 50 index has fallen by -25.4%. So, the above return should be seen in light of this decline.

This also roughly corresponds to the correction that the 2012 Dom Pérignon price has undergone over the same period. This is interesting because you now have the opportunity to buy a product for €160* that a year and a half ago was merrily trading at €210*.

The product has not changed other than becoming more mature and therefore more attractive.

*Vintage 1998, 1999, 2000, 2002, 2003, 2004, 2005, 2006, 2008, 2009

3: Quality - Among The Very Best

When it comes to the quality of a wine, the most common way to quantify the quality of a wine is on a 100-point scale used by the world's most influential critics. For assessing Champagne, the most important and influential critics are Richard Juhlin (RJ) and the media of Vinous (VI) and (Robert Parker's) Wine Advocate (WA).

The 2012 vintage was a fantastic vintage in Champagne, which is also reflected in the 2012 Dom Pérignon whose points are distributed as follows:

- RJ: 95

- WA: 96

- VI: 97

This gives an average score of 96.0 points. Across all 12 Dom Pérignon’s released this millennium, this score has only been surpassed once - by the already legendary 2008 vintage (97.0 points on average across the three critics). A vintage that, incidentally, costs around 28% more than the 2012 vintage.

Looking further back at iconic vintages, the vintage of 1996 had an average score of 96.3, while 1988 ‘only’ scored 94.0 points.

2012 Dom Pérignon is one of the absolute greats.

But there are more interesting things to look out for. At the moment, the good, investable and current vintages of Champagne are 02, 08, 12, 13, and 14. But in the article ‘Champagne: The 2024 Spring Preview’, Antonio Galloni of Vinous looks at the conditions of Champagne vintages from 2016-2022 - and it does not look too good in terms of the potential for great Champagne. According to him, the 2019 vintage is the next great vintage we can look forward to - and it will probably take at least 4-6 years before we see great prestige cuvées from the 2019 vintage. In other words: It looks like good Champagnes will be few and far between in the coming years, which is good news for the wine investor with good vintages in their portfolio.

With the above three reasons in mind, the 2012 Dom Pérignon looks like the perfect investment, and the timing seems very optimal.

Invest directly via the button below or read more about how to invest through RareWine Invest further down the page.

2012 Dom Pérignon

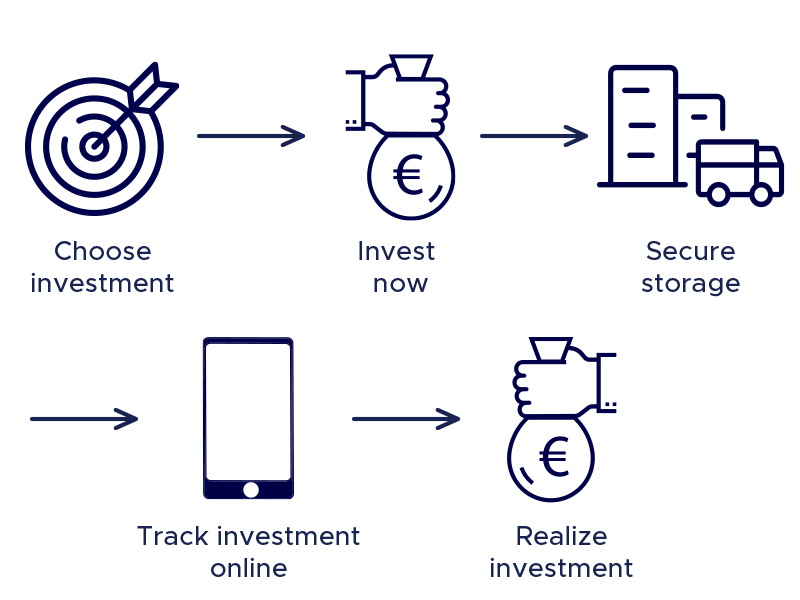

How Investing In Wine Through RareWine Invest Works

Becoming a wine investor with RareWine Invest is easy and you can get started right away.

- You will find an investment case that suits you - for example, this one.

- Click ‘invest now’, decide on a quantity and make the investment.

- Your wine is delivered to a bonded warehouse where it is stored on your behalf through us. Here it is stored safely, securely and insured - and is your property.

- You get access to MyRareWineInvest - an online platform where you can track your investment.

- When you want to realise your investment, simply put your positions up for sale through MyRareWineInvest and we will do the rest for you.

You can also read more under How to invest or under Frequently asked questions.