Market Analysis - Whisky - 29. September 2023

Whisky Investments: What You Need To Know About Investing In Whisky

Whisky has long been an attractive asset, but the market is becoming more nuanced, and the future looks even more exciting. Understand whisky investments with this article.

Liquid Gold

When the refined golden drops are sometimes referred to as liquid gold, there is something to it. For the wealthy, the choice may be between a bottle of 60-year-old The Macallan or a large house and family car in a fashionable urban neighbourhood (depending on where in the world you live, of course). Or how about a bottle of Yamazaki, which makes a bottle of Romanée-Conti look like an everyday wine in terms of price?

The world of whisky is marvelous, and as an investment asset, whisky has also been sublime, returning over 400% over the past 10 years. But are whisky the right investment for you? Do you have to choose between a house with a car and a bottle of whisky, or are there alternatives? Find out more about:

- Whisky investment.

- Which whiskies are suitable for investment.

- Historical performance.

- and perhaps most importantly: the future

But first, a little clarification. There is whisky. And there is whiskey. And there is a difference that not all writers necessarily consider. Whiskey with an e comes from Ireland or the US, while whisky without an e is from Scotland, Japan or even Canada. But here there is a further differentiation, and it is worth bearing in mind: Scotch whisky (scotch) must, in addition to being produced in Scotland, mature for a minimum of three years in casks before it can be called (scotch) whisky - and that is a seal of quality.

Bottle Or Cask

When you invest in whisky, you either buy the finished product, bottled, and packaged, or you buy a freshly filled cask or part of a cask. The latter is because distilleries used to offer this to create liquidity while the whisky matured on its own account - similar to the pre-sale "en primeur" in Bordeaux. Today, this is typically not possible for the large and established distilleries, as liquidity is not as much of a challenge and the finished product is of far greater value to them. However, smaller or start-up distilleries often offer this option. However, investors should be cautious here, unless passion and affection are involved, as such a distillery typically has no historical evidence that the price will increase.

In Which Whiskies Should You Invest?

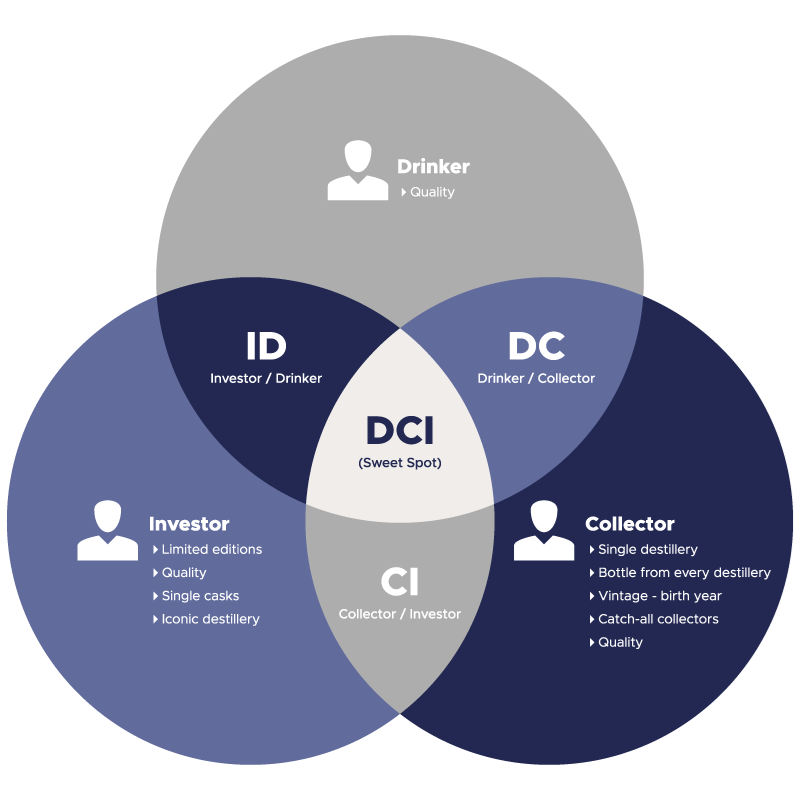

The world is full of great whisky and in Scotland alone, it is estimated that more than 22 million casks are maturing and waiting for their time. But just like in the world of wine, just because something tastes good does not mean it is worth investing in. Here, the DCI model can help you map out which parameters can play a role in making a good investment. The DCI model compares the different needs of different whisky lovers, and the more parameters that can be ticked and the more segments the bottle appeals to, the more suitable it will be for investment:

The DCI model - Drinker, Collector, Investor

The DCI model - Drinker, Collector, Investor

In other words, if you get your hands on a high-quality bottle (end user) from a perhaps shut-down distillery in a numbered bottle (investor), which may even be a component in a series or collection (collector), then it really starts to look like something.

To further elaborate on this, look towards the best distilleries in Japan and even more so towards Scotch single malt whisky. See for example Rare Whisky 101's Collector's Index, which only features Scottish distilleries, while some Japanese jewels have made their way onto wine-searcher.com's list of the most expensive whiskies on the open market at the moment.

Why Single Malt Scotch Whisky?

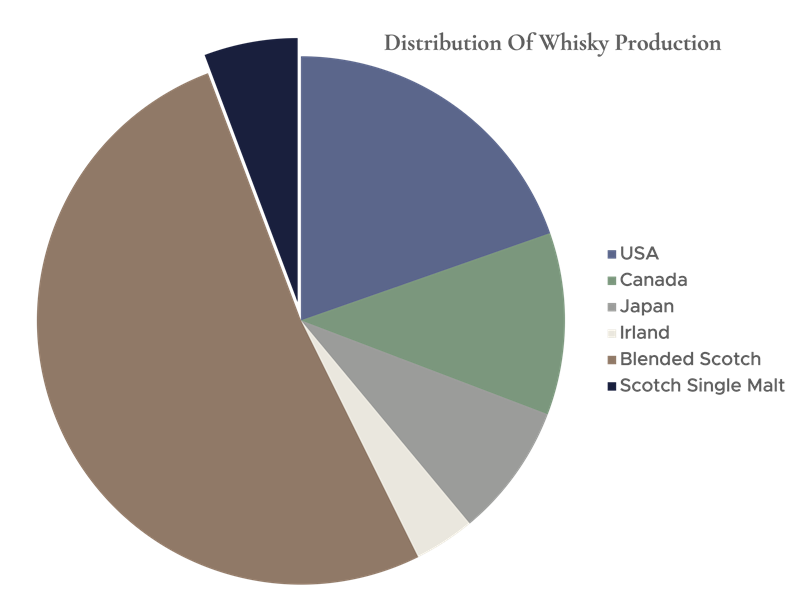

Above we talked about both Scotch and Japanese whisky, but if you find a bourbon whisky that embraces all three segments, you are also well on your way. That said, most whisky investors should turn their attention to Scotch single malt. The demand and history are there, while the supply in the classic supply and demand mechanism is particularly interesting. Scotch single malt takes up very little space in global production between the leading producing countries:

Historical Performance

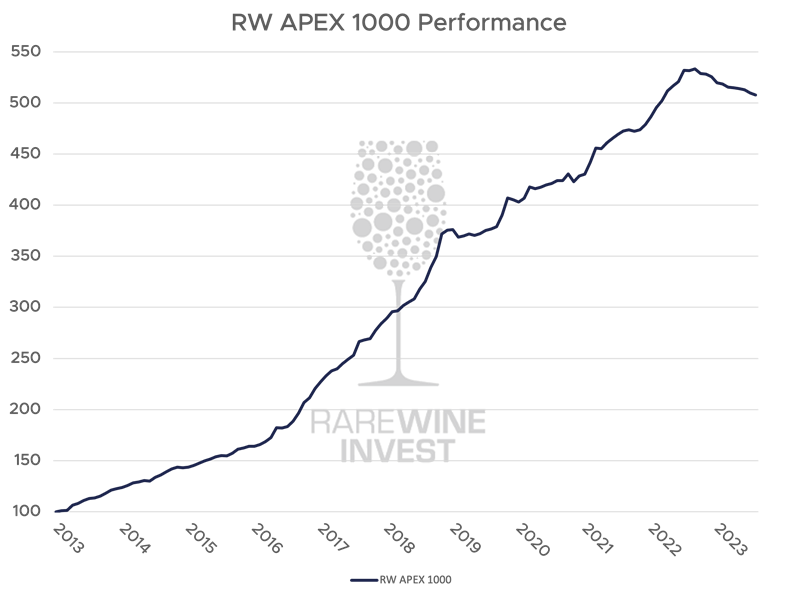

Whisky has historically delivered some very strong returns and has been recognised year after year as the best performing asset in the so-called "collectable" category, which otherwise includes watches, jewellery, art, sports cars and even wine, in the acknowledged and annually published "The Wealth Report" by the global consultancy Knight Frank.

This is based on auction and trading data collected by Rare Whisky 101. Their broadest index, the RW APEX 1000, has risen 407.8% since its inception on 31 December 2012, an average annual growth of approximately 16.7% for more than 10 years. But it is not only the astronomically expensive and hyper-rare bottles that are pulling up. Even more generic whiskies such as Macallan's Double Cask and Sherry Oak or Diageo's relatively accessible bottles from the Flora & Fauna series (now the Special Release series) have also seen price increases of 30, 40 and 50% in recent years.

The picture emerging is that the opportunities are not only among the rarest and most iconic bottles, but that there are also good opportunities among whiskies undergoing high levels of consumption.

How To Store Your Whisky Collection

If you are investing in whisky, it is important to understand the proper storage, as the condition of the bottle and its contents is crucial to the value of the bottle. Here are some basic rules to keep in mind:

- Unlike wine, whisky should be stored upright as strong spirits will damage the cork.

- Avoid exposing the bottles to daylight/UV light, which can affect the taste and colour of the whisky, but also negatively affect the packaging.

- Store the whisky in a stable environment with constant temperature and humidity. Exactly what temperature and humidity can vary, but we recommend around 12 degrees and 70% humidity.

- Be careful when handling the bottles and keep the bottles in their original packaging as much as possible. This helps protect labels and corks from damage.

- If you are investing professionally and for return on investment, it is essential that you can buy without paying VAT, which will be lost when the bottles are realised. This can be done, for example, by investing through RareWine Invest, which gives you access to bonded storage, where other criteria, including security, handling, and insurance, are also taken care of for you.

Powerful Forces Are Expanding In The Whisky World

In the world of whisky, there are plenty of independent producers and blenders, but a massive portion of the market is divided between a few dominant players, illustrating that the global spirits and whisky market is BIG business. And to understand the future potential for the whisky investor, it is relevant to understand these players:

Diageo: In addition to a product portfolio that includes giant brands such as Guinness, Tanqueray and Smirnoff, Diageo also has an impressive whisky portfolio that, in addition to the world's best-selling Scotch whisky, Johnny Walker, includes icons such as Talisker, Brora, Port Ellen, Lagavulin and many more. Diageo had a turnover of £ 17.1 billion in the last fiscal year (22/23).

Edrington: Edrington is the company behind perhaps the world's most prestigious distillery, The Macallan, but they also own brands such as Highland Park, The Glenrothes, Brugal and The Famous Grouse. Edrington's turnover in the 22/23 fiscal year was £ 1.1 billion. Edrington is also partly owned by Beam Suntory, which owns brands such as Scottish Laphroaig, Bowmore and Japanese Yamazaki, Hibiki and Hakushu.

Pernod-Richard: With 240 spirits brands, Pernod-Richard is another giant that is strong in almost every category with Martell cognac, Absolut vodka, Beefeater gin, Havana Club rum and Pierre Jouet Champagne - just to name a few. Pernod-Richard is also strong in Scotch whisky with brands such as The Glenlivet (the world's second best-selling single malt Scotch), Chivas Regal and Ballantine's. Pernod-Richard had a turnover of €10.7 billion in 2022.

And these giants have no plans to stand still - they are investing heavily in both the spirits segment, but especially in the whisky industry. In 2018, Edrington unveiled a £ 500 million investment in The Macallan, which included £ 140 million for The Macallan Estate - a visitor centre and distillery, with the rest going towards increasing storage capacity and upgrading their famous cask production programme.

Pernod-Richard announced in December 2022 that the group will invest €400 million in more sustainable production in its Irish whiskey and Scotch Chivas brands, as well as $250 million in its American whiskey production. In addition, in May last year, it was announced that a $111 million investment will be made in the Scottish single malt distilleries Aberlour and Miltonduff.

Diageo is also investing heavily and has invested more than £1 billion in their whisky infrastructure over the past 10 years - including a flagship visitor centre for Johnny Walker, as well as upgrades, expansions and/or reopenings of Glenkinchie, Caol Ila, Clynelish, Cardhu, Port Ellen, Brora etc.

These monstrous investments are not being made for fun, much less should be able to do so if these companies are looking into a future of normal organic growth. But something tells us that they expect something else. Do they know something we do not? They certainly know how much they have in stock and how much they can produce. And they are closely following the same macro trends that we are also watching.

The Future Outlook For The Whisky Market And The Whisky Investor

Despite historical ups and downs, whisky never really seems to go out of fashion and the category only looks set to grow in the future. According to Allied Market Research, the global (malt) whisky market is expected to grow by an average of 4.7% per year for the next ten years. However, such forecasts are largely based on what can be reasonably predicted and expected, and the trend could well accelerate further.

For example, there is massive potential in India. India is by far the world's largest whisky market* and in fact the world's third largest importer of Scotch whisky (by volume) with 95 million bottles by 2020, according to The Scotch Whisky Association. However, while exports of Scotch whisky to India have increased by 200% over the past decade, it only accounts for roughly 2% of India's total whisky market. This small share is largely due to an Indian import tariff of 150% on Scotch whisky. However, since the above whisky market forecast was made, the UK and India are close to agreeing a comprehensive post-BREXIT trade deal where the import tariff on Scotch whisky will be reduced from 150% to 100%. The Scotch Whisky Association estimates that a reduction in the tariff will result in increased exports to India of €1.1 billion over the next five years. To put this into perspective, exports to India almost doubled between 2021 and 2022 to a total value of €330 million - and the import tariff reduction has not yet taken effect.

But other major economies are also exciting. Among the largest importers of Scotch whisky, there is also growth (by value), with the US the largest (+33% from 2021 to $1.27 billion in 2022) and France the second largest (+26% in 2021 to $589 million in 2022). But China has also moved up the list and is worth keeping an eye on. In just a few years, China has become a permanent resident on the list and is now firmly entrenched as the world's 6th largest importer, increasing imports by 84.9% to $239 million in just one year between 2020 and 2021 and +18% to $281 from 2021 to 2022 - a trend that is expected to continue due to a rapidly growing middle class and increasing prosperity - albeit with more moderate growth rates.

And the whisky desire is like an epidemic spreading through Asia. Of the top 10 whisky importers in the world, half are Asian. And the fastest-growing whisky market in 2022 was also Asian, with South Korea leading the way with 46% growth - and South Korea is not even one of the top five countries in the top 10.

*Whisky in general, not Scotch whisky alone

Scotch whisky exports increased by 27% from 2021 to 2022 to 1.67 billion bottles (0.7l), breaking the £6 billion milestone for the first time.

RareWine Invest's Opinion

As mentioned in the intro, whisky has long been an attractive asset, but there are many indications that the future looks even more exciting. The big players are ramping up, and while this means they will undoubtedly expand their offerings considerably, it is very hard to believe that these companies will allow this to affect the pricing of their prestige products.

Pernod-Richard, Edrington and Diageo are looking into the same forecasts as we are, and all indications are that demand for whisky will reach new heights - both in established whisky markets, but certainly also in developing whisky markets.

But a 20-year-old whisky takes 20 years to mature, and the fact is that good distilleries are far from having an abundance of good old single malt in their cellars. Reliable sources with in-depth knowledge of the industry tell us that not enough has been produced and put into casks to meet future demand. Distilleries have certainly caught up, but due to the long maturation period, we are likely looking at a minimum of 20 years where supply and new releases can in no way match demand - and this is exactly what could make the whisky category even more exciting in the coming years.

If you want to learn more about whisky investment, fill out the contact form further down the page - without obligation, of course.