Investment Tips - Champagne - 12. January 2023

Recommendation: Buy Up In 2007 Comtes de Champagne And Comtes de Champagne Rosé

For approx. three years ago you could invest in 2007 Comtes de Champagne for €70. Today it costs €140. Where will you be in three years?

Comtes De Champagne Is Easy To Understand

Taittinger 's beacon, Comtes de Champagne, is synonymous with prestige Champagne at an unheard-of attractive price. Comtes de Champagne is not a pop club Champagne. Comtes de Champagne is refined luxury, but with a broad appeal that has an extremely wide audience, both through price level and brand. Comtes de Champagne is not difficult to understand nor is it vulgar, as for example Dom Pérignon or Cristal can be perceived as. The prestige cuvées are basically the epitome of lavish lifestyle and extravaganza - Comtes de Champagne is rather laid back cool...

Over time we have bought up 2007 Comtes de Champagne and Comtes de Champagne Rosé and can now offer a batch of these for investment. Dive into the potential of the underplayed and underrated vintage below and get ready for your next Champagne investment.

The recommendation from here is clear: Buy up Comtes de Champagne.

If you want to read more about the history of Taittinger and Comtes de Champagne, you will find all our previous articles right here.

1. act: Comtes de Champagne (regular)

Comtes de Champagne is understated and underrated but can play with the best. The 2007 vintage is no exception – on the contrary. 2007 is a bit of a funny vintage in Champagne, where far from all the big houses found their production worthy of receiving the prestige predicate.

Nevertheless, Taittinger chose to produce a 2007 Comtes and must be said to have got a solid product out of a vintage that is not generally considered a great vintage - yet the vintage has also spawned a Cristal and a Salon, and it is in this perspective, that Comtes de Champagne comes across as underrated. Judge for yourself in this comparison of price and quality between the following top Champagnes:

| Champagne | RJ | WA | VII | AVG | Price |

|---|---|---|---|---|---|

| 2007 Salon | 92 | 96 | 97 | 95.0 | €1,125 |

| 2007 Cristal | 96 | 95 | 97 | 96.0 | €500 |

| 2006 Krug Vintage* | 96 | 97 | 97 | 96.7 | € 310 |

| 2006 Dom Perignon* | 94 | 96 | 97 | 95.7 | €205 |

| 2007 Comtes de Champagne | 94 | 95 | 96 | 95.0 | €140 |

Here it is particularly eye-catching that with a Cristal you have to pay €360 for one extra point, while Salon across the three critics in vintage 2007 is judged completely comparable to Comtes de Champagne despite a price difference of almost €1,000.

Here it is of course relevant to bear in mind that factors such as brand and supply also play a big role. For example, millions of bottles of Dom Pérignon are produced per vintage while only around 60,000 bottles of Salon are produced.

The total production of Comtes de Champagne is not known, but it is estimated that Taittinger produces in the region of five million bottles across ALL wines in the portfolio. Thus, an educated guess is that the production volume of Comtes should be more closely compared to Cristal than to Dom Pérignon.

Anyway; 2007 Comtes represents great Champagne at an attractive price.

Strong Investment With Continued Potential

Although the 2007 Comtes de Champagne continues to look undervalued in terms of price vs. brand and quality, it has already been a strong investment for the investors who invested when we first offered it for investment in December 2019. Back then it cost €70. Today the price has doubled.

If we look in a slightly broader perspective, the British wine exchange, Liv-ex, can report that the last ten vintages of Comtes de Champagne, which have been on the market for a minimum of five years* over the last five years, have on average yielded a return of 122.4%.

At the same time, it is also worth noting that the global interest in Comtes de Champagne is noticeable: since July 2020, Comtes de Champagne has consistently been among the 100 most searched wines on wine-searcher.com. It may not sound like a long time, but this is extremely impressive from a "small" prestige cuvée among ALL the world's wines.

*vintage 1994, 1995, 1996, 1997, 1998, 1999, 2000, 2002, 2004, 2005 and 2006

2007 Comtes de Champagne & Comtes de Champagne Rosé

2007 Comtes de Champagne & Comtes de Champagne Rosé

2. act: Comtes de Champagne Rosé

Like any proud Champagne house, Taittinger also has a rosé version of their prestige cuvée. And as in all other cases, Comtes de Champagne Rosé represents extra luxury and more extravagance than its ordinary counterpart.

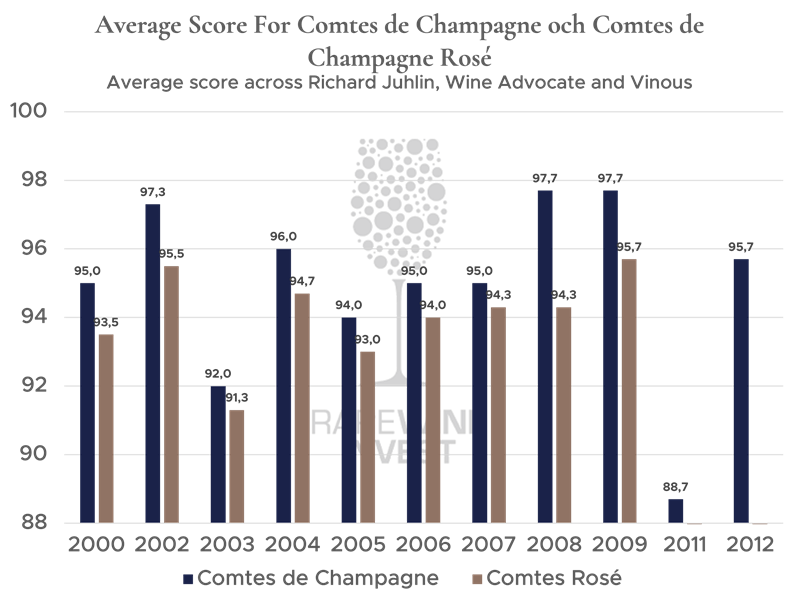

Taittinger got the best out of vintage 2007 in their rosé edition, which actually scores exactly the same as vintage 2008 (94.3p) on an average score among the three most important critics, while vintage 2008 is approximately 65% more expensive than vintage 2007 – just because of the 2008 predicate!

But if we also look here at some of the comparable rosé Champagnes, Comtes Rosé shows massive value for money:

| Rosé Champagne | RJ | WA | WE | AVG | Price |

|---|---|---|---|---|---|

| Cristal Rosé | 96 | - | 97 | 96.5 | €450 |

| Dom Pérignon Rosé* | 94 | 95 | 97 | 95.3 | € 360 |

| Dom Ruinart Rosé | 93 | 96 | 97 | 95.3 | € 215 |

| Counts Rose | 93 | 96 | 94 | 94.3 | € 170 |

| Bollinger Grand Year Rosé | - | 94 | - | 94.0 | €115 |

It is no secret that Bollinger 's rosé also seems to present exciting value, but it is also striking that the major critics have not systematically reviewed either the 2007 vintage or the other vintages. Since it cannot be due to lack of availability, this is perhaps more likely to be attributed to their reputation for this one.

In addition, the relationship between price and quality seems to be in Comtes' favor here as well. Alright, it is awesome to drink, for example, Dom Pérignon Rosé. But Champagne lovers have to ask themselves if it is more than twice as awesome?

Comtes Rosé Has Delivered Stable Returns

The 2007 Comtes de Champagne Rosé was disgorged in December 2018 and released in the spring of 2019. At RareWine Invest, this has been under administration since the summer of 2021 and has since given a return of 36% .

Looking in a slightly broader perspective, the British wine exchange, Liv-ex, can report that the last ten vintages of Comtes de Champagne Rosé, which have been on the market for a minimum of five years* over the last five years, have on average yielded a return of 88.1%.

Champagne investment is interesting, but what makes rosé Champagne extra interesting is the total production:

More than 80% of the global production of sparkling wine in 2017 was white, while only 15% was rosé. About 2% was sparkling red wine. The world's largest producer of sparkling wine was, and still is today, Italy. This means that once the share of Italian and the other French sparkling rosé wines is subtracted, the total production of rosé Champagne is estimated to be extremely limited. This means that even though current consumption is also lower on, for example, rosé Champagne, far fewer bottles must also be drunk in order to lower the global supply as a percentage. As a result, mature rosé Champagne is also extremely difficult to come by today.

Why invest in Champagne?

At RareWine Invest we have recently looked at Champagne and the analysis is particularly relevant now that Champagne is on the agenda, but also relevant in a world that is economically uncertain.

First, Champagne sales are reported to be up in the first half of 2022 compared to the previous year, and the Champagne Committee is expected to announce record sales for 2022. The massive demand has even resulted in Moët running out of Champagne.

Add to this the fact that demand and supply difficulties in 2022 have resulted in the Champagne Committee raising the allowable harvest for 2022 - the challenge is simply that the great Champagnes are aged for 10 years, so it will be a long time before this has any real effect.

Furthermore, Chinese affluent, Western-oriented millennials and Gen Z's are expected to double the size of the wine market in China in particular by 2026 - a China, incidentally, that is expected to be the world's largest market for luxury products by 2025.

In other words, the supply and demand for Champagne are not matching up at all. Not now, and not in the future - something the Champagne investor can take advantage of.

Read the full analysis here: Analysis: The Prospects In Champagne - Will The Corks Pop In The Future?

RareWine Invest’s Opinion

Based on the above, it does not require much understanding of either Champagne or investment to understand the potential of Comtes de Champagne. So instead of dissecting this further, a clarification is in order to help you choose.

Basically, the rosé editions are almost always of higher quality than their counterparts, while they are also always produced on a significantly smaller scale. On the other hand, rosé is also always more expensive than their counterparts and for this reason (as well as smaller supply) is not in demand to the same extent as the regular Champagnes. Here, however, it must be said that we believe that this category has a large future upside - especially due to the extremely limited production of rosé Champagne.

For you, the question is really just whether you want to invest in the regular versions with the good features they come with, or whether you want to pay a little extra for a more specialized product that is produced on a significantly smaller scale - if it is a question at all about choosing one over the other.

In any case, the recommendation from here is clear: buy up the (2007) Comtes de Champagne while it is available.

Invest in 2007 Comtes de Champagne and Comtes de Champagne Rosé

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2007 | Comtes de Champagne | 750 | OC6 | € 140 |

| 2007 | Comtes de Champagne Rosé | 750 | OC6 | € 170 |