Investment Tips - Other - 22. June 2023

Harlan Estate Is One Of Napa Valley's Best, And The 2012 Vintage Now Delivers A Strong Purchase Indicator

99+ from Wine Advocate and a price that has not increased nearly as much as its equivalents - that offers potential.

The wine world seems increasingly plagued by drastic contradictions, with scorching heat, record droughts, wildfires, spring frosts and hail terrorising one year, while the following year is outstanding.

Climate change impacts are evident, and while eco-anxiety is on the rise, ‘things from the past’ are increasingly sought after as the future is uncertain. Harlan Estate represents such a time capsule, with wines of sublime quality that, with their exceptional longevity, can deliver a glimpse of the past to the world's wine lovers and connoisseurs in the future.

This is your opportunity to invest in such a time capsule that has recently entered its optimal drinking window and, according to Wine Advocate, has a lifespan of more than 40 years from now. Learn more about the purchase indication and the case as a whole below.

"First Growth" From Oakville, Napa Valley

In the 1980s, a successful property developer named Bill Harlan had a dream of making exceptional wine in the hilly landscape of Napa Valley. A trip to Burgundy and Bordeaux with American wine legend, Robert Mondavi, ignited the spark and the dream of an American first growth, referencing the greatest Bordeaux wines, became a reality. Harlan Estate was born in 1984 and will celebrate its 40th anniversary next year - and it would be strange if this is not marked, while it is undoubtedly something that will focus the wine world's attention on Oakville and Harlan Estate.

Annual Production

When you talk about the best American wine, you are implicitly talking about Napa Valley wine. When it comes to the biggest, best, and most famous, Screaming Eagle, Harlan Estate and Opus One top the list.

With American wines, we are more accustomed to larger productions, as Napa Valley, for example, is not as heavily regulated as we know it from Burgundy. Opus One is a good example of this, where they have successfully, without destroying the brand, ramped up production to meet demand and today produce around 300,000 bottles per vintage.

The situation is different at Screaming Eagle and Harlan Estate, where they produce up to 12,000 bottles per vintage and 25,000 bottles per vintage, respectively. This is more like something the wine connoisseur will recognise from Burgundy, and is thus the foundation of the uneven supply/demand ratio that this case highlights.

”Extraordinary Wine Of Profound And Complex Character..”

When it comes to the best American wines, producers manage to score impressive points, often year after year. But before you become accustomed to these exceptional scores, it is important to remember what the scores actually stand for. Robert Parker, the creator of the 100 point scale, defines it as follows:

- 90 - 95 point: An outstanding wine of exceptional complexity and character. In short, these are terrific wines.

- 96 – 100 point: An extraordinary wine of profound and complex character displaying all the attributes expected of a classic wine of its variety. Wines of this caliber are worth a special effort to find, purchase, and consume.

According to the wine guru, we are dealing with "outstanding" wine from 90 points, but over the last 20 vintages, Harlan Estate has only delivered below "extraordinary" in the eyes of Wine Advocate on a few occasions. The 2012 vintage, on the other hand, has come so close to the perfect 100 points with 99+, and a remark from the tasting that this is a candidate for the 100 points after a few years in the bottle (which, by the way, is now...).

Vinous and James Suckling do not hold back either, giving 97 and 98 points respectively. The average score for the 2012 vintage across the three critics is 98 points. If we look across all vintages from 2005 to 2019 (vintages where all critics have consistently reviewed), Harlan Estate scores 97.8 points. If we look at Wine Advocate (which is the largest Napa specialist of the three), the average over the last 20 vintages (2000-2019) is also 97.8 points. In other words, with one or two exceptions, there is no such thing as an average Harlan Estate - only "extraordinary" wines, and here the 2012 vintage is firmly placed in the centre. Or at the very top if you ask Wine Advocate.

Growing Wine Market And Shifting Consumer Trends

The US wine market is expected to grow by 7% per year until 2030, based on value, which is actually one percentage point more than the expected European growth over the same period.

At the same time, the US is by far the world's largest club for dollar millionaires, emphasising that the audience for Harlan Estate is very much in Harlan's home market.

At the same time, there are some interesting observations to be made in consumer trends. According to WGSN, a market leader in trend forecasting, one of the major trends is that consumers are shifting their focus from quantity to quality, and for many, quality will always beat quantity. In other words, when it comes to enjoyment, it has to be done properly. These consumers prioritise great experiences and are willing to pay more for quality - a segment where the world's top wines, including Harlan Estate, fit in particularly well.

Solid Investment With Untapped Potential

Harlan Estate has historically been a solid investment that has, for example, over the past five years, across the past 10 vintages, returned 42.6%, or 7.4% on average per year* - increases driven primarily by the older vintages.

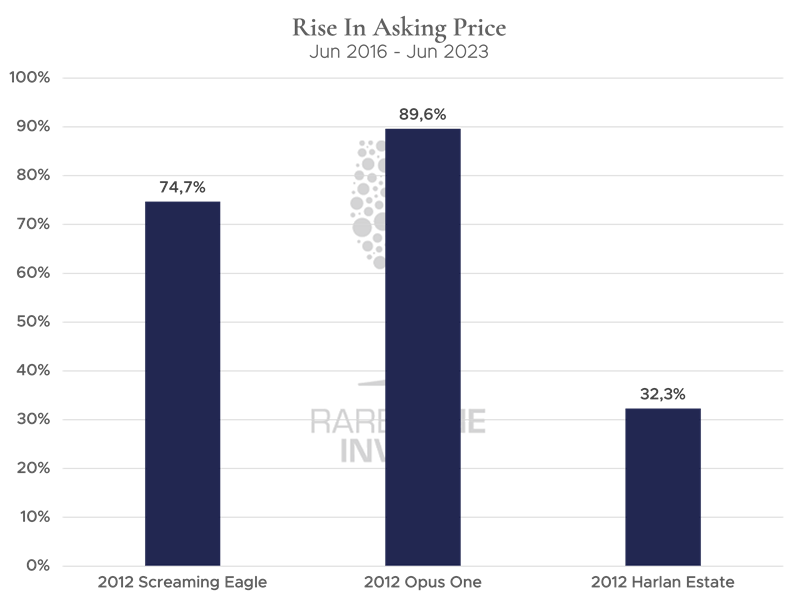

But it seems that the potential lies ahead. Comparing the three American flagships, Screaming Eagle, Opus One and Harlan Estate, the 2012 vintage has seen the asking price increase significantly more for Screaming Eagle and Opus One over the past seven years (when all three wines were on the market and prices had stabilised):

Data: wine-searcher.com

Data: wine-searcher.com

2012 Harlan Estate has been awarded 99+ points by WA, while Screaming Eagle has been awarded 100 points and Opus One has been awarded 96. Compared to Harlan Estate, Screaming Eagle only produces about half the amount, while Opus One produces ten times more than Harlan Estate. So, it makes no sense that the asking price of Screaming Eagle and Opus One has risen more than twice as much over the past seven years as it has on the Harlan Estate - and this even includes a drop of approx. 13% on 2012 Screaming Eagle since the peak in October 2022!

For the 2012 Harlan Estate, which according to Wine Advocate entered its optimal drinking window in 2018 and will be there until 2068, it is hard not to expect a great future. And with the price trends compared to the other two Napa icons, the purchase indicator is hard to miss.

*Vintage 2005-2014 - data from Liv-ex

RareWine Invest's Opinion

With 99+ points from Wine Advocate, there is no doubt that we are dealing with exceptional wine that belongs among the top three fine wine icons from the American continent.

In just 40 years, Harlan Estate has made itself an institution on the Californian wine scene and presents wines with an exciting mix of exclusive production (approx. 25,000 bottles per vintage) at a price range where many can participate - and far from being Screaming Eagle expensive.

With an investment in the 2012 Harlan Estate, you are not only investing in top Napa Valley, but in wine of towering quality and longevity. But most interestingly, the price of Harlan's equivalents has more than doubled in the last seven years - something that has all the purchase indicators signaling that it is time to buy.

Add to this the fact that Harlan Estate will celebrate its 40th anniversary next year and it is hard to believe that this will not increase the focus on Harlan Estate.

Invest In 2012 Harlan Estate

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | Bottles available | PRICE/BTL.* |

|---|---|---|---|---|---|

| 2012 | Harlan Estate | 750 | OWC6 | 30 | € 950 |

| 2012 | Harlan Estate | 1500 | OWC3 | 6 | € 2,000 |