Investment Tips - Champagne - 26. October 2023

Goosebump-inducing Krug Clos du Mesnil for investment

Krug Clos du Mesnil is exclusivity to the utmost degree and a rare guest at RareWine Invest. It is a buyer's market, providing rare opportunities.

“Every time I encounter my favorite wine, Krug Clos du Mesnil, I get goosebumps while my senses are heightened”

- Richard Juhlin

Richard Juhlin is the world's leading Champagne critic, and he makes no secret of the fact that he is in love with Krug Clos du Mesnil. So is the whole world, which is why each release comes with massive inherent demand. This is why we vacuum up all the Krug Clos du Mesnil we can get our hands on, and now we have finally managed to acquire investment-grade quantities that you now have the opportunity to invest in.

Krug Clos du Mesnil is the epitome of greatness. The epitome of rarity. The epitome of exclusivity. And really, that is all you need to know, although there are more investment arguments below.

2004 and 2006 Krug Clos du Mesnil is available for investment – read more below.

Krug - A Perfect Producer Of Absolute World Class ✩✩✩✩✩

This article was opened by Richard Juhlin's praise of Krug Clos du Mesnil, which is the main character here. Krug is the sender, and although the quote referred to a single wine, Juhlin's enthusiasm flows through the entire Krug Champagne House.

In addition to the well-known 100-point system, Juhlin also operates with The Stars, which is a ranking of producers. Only five Champagne houses have achieved the maximum five stars, which symbolizes "A perfect producer of absolute world class right through the entire range". Krug joins Bollinger, Louis Roederer, Salon, and Jacques Selosse in the top Champagne hierarchy.

Krug - A Champagne Luminary In The Ultimate, Exclusive Potency

The Krug Champagne House was founded by Joseph Krug in 1843. When he died in 1866, his son Paul Krug was able to build on a stable foundation - he established his base in Reims and brought the house into the inner circle of the Champagne elite. Krug is a symbol of superior quality, expertise, and passion.

Since then, generation after generation has helped to strengthen the already solid Champagne house. Joseph Krug II ensured that Krug survived World War I and flourished with iconic vintages such as 1926 and 1928. Next, brothers Henri and Remi Krug introduced the first rosé Champagne, and it was even them who acquired the legendary and prestigious Clos du Mesnil vineyard.

Krug has cemented their rightful place among Champagne's best. Krug members have managed the golden heritage and unwavering commitment to quality and the importance of close friendships with other Champagne producers.

And although Krug gained prominent ownership in 1999 with the LVMH Group at the helm, the decision was made to keep the Krug family close to maintain and preserve the house's heritage. LVMH is also behind brands such as Château Cheval-Blanc, Château d'Yquem, Clos des Lambrays and Newton Vineyards, as well as Glenmorangie, Belvedere, and Ardbeg. Of course, ownership means that there is financial capital and thus strong forces in the engine room.

Read the full story of Krug here: Krug Champagne - The Story Of A Complete Symphony Orchestra And Inherited Perfect Champagne Spirit

Krug Clos du Mesnil: A Rarity On Release - A Rarity At RareWine Invest

Clos du Mesnil in Mesnil-Sur-Oger is an extremely rare single vineyard Champagne. The 1.84 hectare "large" vineyard was acquired in 1971. Krug is the sole owner of the vineyard and thus Clos du Mesnil is also a so-called 'Monopole'. The grapes from the vineyard had been used for the Champagne Salon until Krug's acquisition. Since 1698, the vineyard has been surrounded by a stone fence (clos), and Chardonnay has been planted in the vineyard for just as long.

Clos du Mesnil is only released in the very best vintages, and the total production per vintage can approach around 12,000 bottles. By its very nature, this means that Krug's Clos du Mesnil is already rare upon release - and of course, this also means that there is not enough for everyone. Therefore, it is also rare that we can offer Krug Clos du Mesnil widely for investment.

The Exclusive Club Of High Scores

If we stay in the Juhlin ranking system for a moment, it becomes clear that Krug is something very special. Juhlin's absolute best point classification is in the "world class Champagne" category, where wines with 95-100 points can call themselves honorable members.

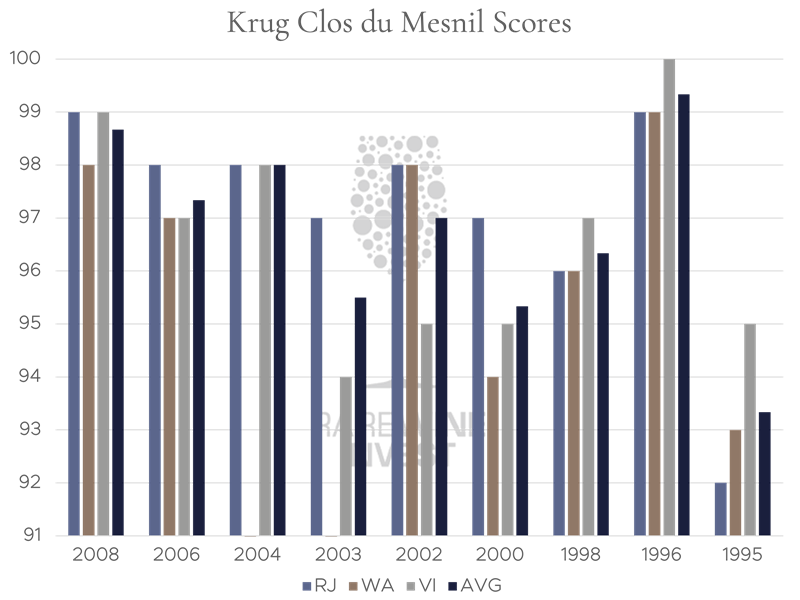

In the chart below, only the 1995 Krug Clos du Mesnil is not in the top category from Juhlin's point of view.

In this investment tip, both the 2004 and 2006 Krug Clos du Mesnil are available for investment, and according to the chart below, there is little to separate them. 2004 Krug Clos du Mesnil receives 98 points from Juhlin and Vinous, while Wine Advocate has not yet had the opportunity to give its verdict. 2006 Krug Clos du Mesnil also receives 98 Juhlin points, while both Vinous and Wine Advocate award 97 points.

This means that across the critics' scores, the 2004 Krug Clos du Mesnil scores 98 points, while the figure is 97.3 points for the 2006 Krug Clos du Mesnil. It is also worth noting that James Suckling awards 99 to the 2006 Krug Clos du Mesnil, while he awards 98 points to the 2004 Krug Clos du Mesnil. However, he has not consistently tasted through the Clos du Mesnil vintages, so his sporadic scores are not included below.

The fact is; there is no such thing as a bad Krug Clos du Mesnil, but both 2004 and 2006 represent the very best.

How Krug Clos du Mesnil Performs At RareWine Invest

It is no secret that we offer any Krug for investment - no matter the vintage and no matter the wine. We do this because Krug has a history of strong performance, and Clos du Mesnil is no exception. All Krug Clos du Mesnil* under the management of RareWine Invest since March 2020 have returned an average of 67%, which equates to an annualized return of 16%. So, while returns cannot be guaranteed, Krug's Clos du Mesnil has historically delivered market-beating returns regardless of vintage.

In 2020, you were able to invest for the first time in 2004 Krug Clos du Mesnil at €825. In the same year, you could invest in the new release: namely 2006 Krug Clos du Mesnil - also at €825. Had you invested then, today you would have achieved a return of 45% and 33% respectively, which corresponds to an average annual return of 11% and 9% respectively - and here it is worth noting that these two vintages are still very young, so the real potential lies ahead when the already sparse quantities are further reduced.

Add to this that the drinking window, according to Vinous, is 2019-2044 for the 2004 Krug Clos du Mesnil, while it is 2022-2045 for the 2006 Krug Clos du Mesnil. Both have a long life ahead of them.

*Vintage 2004, 2003, 2002, 2000, 1998, 1996, 1995, 1990, 1985 and 1979 in regular size bottles.

"Let Them Drink Champagne"

Lately, we have been arguing that you should stay true to your investment strategy - even in a turbulent market that is currently operating in the buyer's favor. Champagne has seen a massive surge in interest over the last few years, resulting in huge price increases (though not yet like what we have seen in Burgundy). Despite a short-lived 10.4% decline in the Liv-ex Champagne 50 index in the first half of 2023, Champagne still stands as the most traded wine in both value and volume during this period.

Read more in our article: Analyzing The Fine Wine Market: Navigating Value And Realities

Liv-ex further states that despite falling prices across the entire market, Champagne has seen stable trading levels. In 2022, 5,298 cases of Champagne were traded, which amounted to £11.3 million in trade. By September 2023, 3,135 cases had already been sold. And with the arrival of Christmas and New Year (and Chinese New Year), trading activity is expected to increase. "Let them drink Champagne", says Liv-Ex.

Champagne is in demand.

RareWine Invest's Opinion

When a wine gives the world's number one Champagne expert goosebumps, it is worth paying attention. Attention to your own opportunity for consumption or attention to your own opportunity for investment. Because when it comes to Krug Clos du Mesnil, there is no such thing as a bad vintage. And with Krug Clos du Mesnil, the quantities are so sparse that it is not a matter of when you can get access - but whether you can at all.

For this reason, there are only 35 bottles available through this investment tip, so as always, it is first come, first served.

Great historical returns have set the course for the future. And both the 2004 and 2006 Clos du Mesnil are still in their infancy. There is a demand for Champagne, and there will always be great interest when world class Champagne like Krug is the sender - especially when the wine is called Clos du Mesnil.

We do not recommend one over the other as they are on the same level of quality.

Invest In 2004 And 2006 Krug Clos du Mesnil

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2004 | Krug Clos du Mesnil | 750 | OWC1 | € 1200 |

| 2006 | Krug Clos du Mesnil | 750 | OWC1 | € 1100 |