Investment Tips - Champagne - 28. March 2023

Buyer's Market: Buy Into 2012 Cristal

The financial markets are in turmoil, and this is now creating lucrative conditions for buyers in the wine market. We recommend: Buy into Cristal

About Champagne And Turmoil

Cristal hardly needs much introduction - neither as a Champagne nor as an investment asset.

Cristal has a unique combination of superior quality and an exclusive brand that really oozes prestige and high-class. Cristal has therefore also guaranteed solid returns for Champagne investors, and as one of Champagne's flagships, it has delivered both solidity and capital appreciation.

Now, however, the waves in the financial markets have begun to ripple and potential storms are on the horizon - something we have become accustomed to being without, but which is not the first time we have potentially had to go through.

Conditions have changed, and we are now in a buyer's market in the wine market - this means that lucrative opportunities for acquisitions have arisen, which actually resemble something we have seen before.

We have a rule of thumb that says that if, at a given time, you can buy, for example, Cristal cheaper today than you could yesterday, then it is time to strike.

Find out more about our recommendation for 2012 Cristal in the buyer's market below.

2012 Cristal: In The Class Of The Greats

Before we get into the details of the options in the buyer's market, however, it is relevant to establish the format of Louis Roederer's prestige cuvée from the 2012 vintage.

Across the most important critics, Richard Juhlin, Wine Advocate and Vinous, the 2012 vintage scores no less than 97.3 points on average. This is the same as the 2014 vintage and is in fact only surpassed by the 2008 and 2002 vintages (both with 98.0 points on average). At least in recent history.

It is also worth noting that Richard Juhlin gives the 2012 vintage 97 points, which is the same as he has given, for example, the 2008, 1996 and 1988 vintages, which are some of Champagne's greatest reference vintages.

2012 Cristal is thus among the greatest prestige cuvées that Louis Roederer has released to date.

"Be Fearful When Others Are Greedy And Greedy When Others Are Fearful"

The above is, of course, a quote by the legendary value investor Warren Buffett, and he's probably on to something, although human psychology can be hard to overcome.

Financial markets are in turmoil, the world is holding its breath as we wait to see if another financial crisis is on the way, while central banks continue to turn the interest rate dial. As an expected consequence, shocks like these take liquidity out of the markets, which of course also affects the wine market. As a consequence, prices may fall. Our valuations of wines under administration must also be representative of the market we are in, and even though a long holding period is planned, the current valuations must correspond to the level of the market.

As a consequence of these circumstances, we have now been greedy while the market is nervous, and obtained a quantity of 2012 Cristal that you can now buy at compared to what they cost in the autumn.

And actually, it looks like something we've seen before...

This Is What Happened The Last Time The Market Crashed

In fact, it is very rare for the price of wine to fall in the long term, which is why wine should be seen as an asset with a long investment horizon. And this is exactly what we had to remind investors of when we faced a similar situation in 2019.

On top of a record year for wine investors in 2018, the trade war between the US and the EU, civil war-like conditions in Hong Kong* and, not least, the fuss about Brexit** created problems on world markets, removing liquidity from the wine market.

Periodically, it was not the most exciting development to watch, but those who invested before and during this are some of those who are smiling the most today.

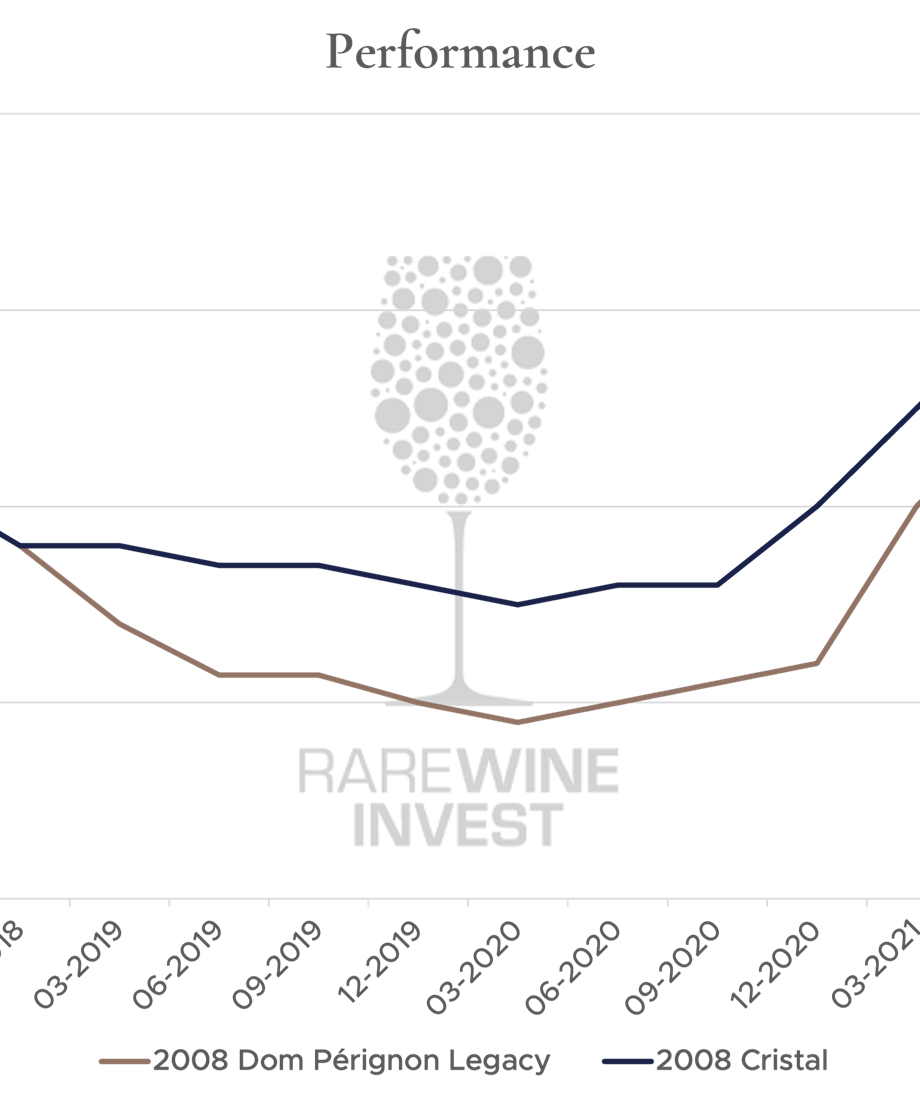

Below are the performances of two prestige cuvées, both of which were fairly new to the market at the time, and both of which illustrate very well the evolution the wine market was going through at the time.

For those who bought earlier than this, we urged caution. For those who had the opportunity, we had strong buy recommendations.

*Southeast Asia's hub for wine trade

**London is the world's most important city for fine wine trade

Based on own data on wines in whole cases and perfect condition

Based on own data on wines in whole cases and perfect condition

RareWine Invest’s Opinion

How the world and markets will evolve is anyone's guess, and when it will turn is anyone's guess. However, it looks like something we have seen before, and if history and cycles repeat themselves as they tend to do, wine will continue to be an attractive investment in the future.

What it really comes down to is whether you still believe in the fundamentals and how much ice you have in your stomach. Would you invest in a product that a few months ago was difficult to find in quantity and at a discount of almost 9%? Do you think it will come down further? Or have we reached the level where the professional players in the market are pouncing, buying up and thus keeping their hand under the price? In any case, our purchasing department is on the move.

The future is hard to predict, but what is certain is the opportunity we have right here, right now, and we have a strong buy recommendation.

The basic premise is the same. The product has not changed. This is still an investment case with all the right components - just now at an even more attractive price than a few months ago.

If you believe in the product and the basic premise, this is a great opportunity to either get started with a great prestige cuvée as the backbone of your investment or to add more to your portfolio.

Invest In 2012 Cristal

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2012 | Cristal | 750 | OC6 | € 260 |