Investment Tips - Champagne - 23. May 2023

2012 Cristal Rosé On Magnum: “Truly Magical”

Limited-edition high-end Rosé Champagne has delivered stable returns. But it is the future thirst for Rosé and the scarcity of supply that will really boost its potential.

”The 2012 Cristal Rosé is magnificent […] Readers who can find the 2012 should not hesitate, as it is truly magical”. Antonio Galloni, Vinous, 98+ point

”A little shy so that many may miss the grandeur of this ultra-elegant super-sophisticated surreal floating and sublime wine […] but to enjoy its full potential we have to wait until at least 2025. – Richard Juhlin, 98 point

Louis Roederer is one of the world's greatest Champagne houses, with Champagnes attracting the attention of every high-end Champagne connoisseur around the world. This investment tip offers the opportunity to invest in the 2012 Cristal Rosé on Magnum, which ranks among the very best Cristal Rosé Champagnes.

'Steady price performance' characterises Cristal Rosé, but Liv-ex predicts the Rosé category as potential future 'best price performers'. Read more about the potential of a limited rosé category here.

Read the full story of Cristal's fabulous history in the article: The Myth Of Cristal: Crystal Clear, Exclusive And Tamper-Proof

2012 Cristal Rosé Is Almost Perfect

Keeping superlatives alive on this channel is an art, since even the 'least sublime' wines you encounter here are among the world's best. So, until there are words that can surpass 'magnificent', 'legendary' and 'sublime', these will have to do for a little while longer, in the hope that they have enough authority in this case to describe Rosé Champagnes from an elite house that, in its best vintages, is a millimeter away from perfection.

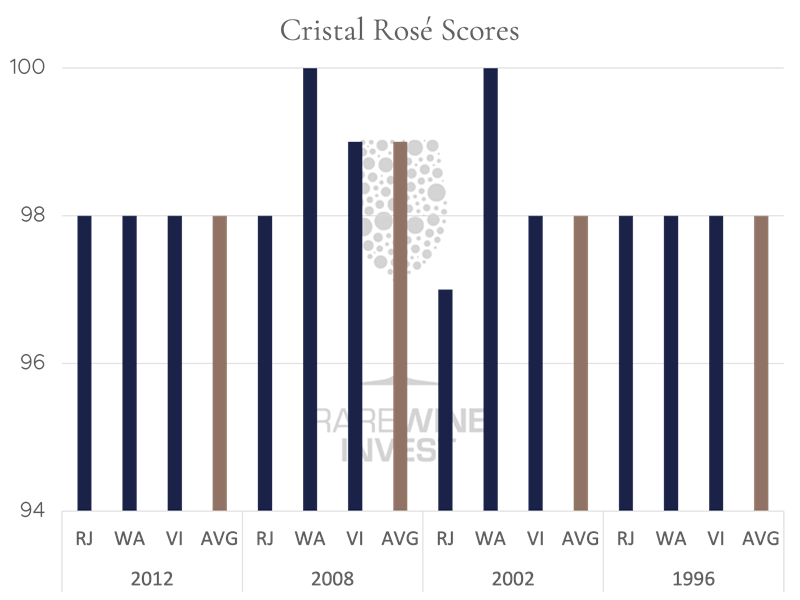

The 2012 Cristal scores 98 points from Richard Juhlin, 98 points from Wine Advocate and 98+ points from Vinous, and with an average (avg.) score of 98, it ranks in the top 5 of the best Cristal Rosé Champagnes ever*. Add to this the fact that all the vintages in the chart below have a better average score than the white Cristal – and that says a lot.

Of the vintages listed above, there is a very close race between the 2012, 2002 and 1996 vintages. According to price trends reported by wine-searcher.com, the price of 2002 Cristal Rosé has increased 100.9% in 10 years, while the trend is 127% for 1996 Cristal Rosé. In terms of quality, the three vintages are similar, and the two predecessors have doubled their price in a decade...

*Neither 1988 nor 1979 are included here, as they have not been assessed by all three of the above critics, although 1989 gets 99 points from Vinous, and 1979 ditto from Richard Juhlin.

Liv-Ex:” Rosé Champagne’s Steady Price Performance”

At the end of February 2023, Liv-ex took stock of Rosé Champagne's performance. They point out that over the past year, the rosé Champagne index has risen 7.1%, almost matching the +7.6% rise in the Champagne 50 index - although the rosé Champagne index has been more stable.

Champagne 50 has indeed had some tumultuous few months, dominated by more fluctuations than usual, while rosé Champagne has not experienced the same fluctuations. The index for rosé Champagne had a strong start to 2022, falling by 1.8% in July 2022, but then rising by 3.4% between August and October. Add to this the fact that, according to Liv-ex, trade in rosé Champagne has increased by 17.5% during 2023.

Rosé Champagne has become a more significant part of the high-end Champagne market over the past decade, but why the index for rosé Champagne is more stable than the Champagne 50 index is difficult to determine with certainty - the most likely reason seems to be high quality and very low supply. In 2019, for example, only 15.4 million bottles of Rosé Champagne were produced, representing only 5 % of total overall Champagne production.

And this 2012 Cristal Rosé is even in magnum format, making it even more limited than its regular format counterparts.

Performance of Cristal Rosé

According to Liv-ex, the last 10 vintages* of Cristal Rosé that have been on the market for at least five years have returned an average of 60.5% over the last five years, giving an average annual return of 9.9%. This scenario also plays out at RareWine Invest, where all Cristal Rosé** we have recommended for investment has returned an average annual return of 9% since the first date of investment advice.

It is also worth pointing out that in September 2020, you could invest in 2012 Cristal Rosé on Magnum. Had you invested then, you would have realised a return of 38% today, which equates to an average annual return of 13%.

The above only reinforces Liv-ex's conclusion that rosé Champagnes are performing at a solid and stable level. But if demand increases even slightly, supply will not be able to keep up - and this is where the Rosé category becomes really interesting.

*Vintages: 1995, 1996, 1999, 2000, 2002, 2004, 2005, 2006, 2007, 2009

** Vintages: 2013, 2012, 2012 (MAG), 2008, 2008 (MAG) and 2005

The Best Price Performer Of The Future?

The quote at the top of this article relates to Antonio Galloni's tasting of 2012 Cristal Rosé on Magnum - and here Galloni articulates the exclusivity of the Magnum format in an already luxurious category: If you can get your hands on 2012 Cristal Rosé on Magnum, do not hesitate to go for it.

Rosé Champagnes are produced in much more limited quantities because production is significantly more demanding - and Liv-ex reports that buyers looking for options other than white Champagnes will seek out brands such as Comtes de Champagne, Dom Pérignon and Cristal because of their credibility.

”However, as this market segment evolves this lack of liquidity, if it is coupled with rising demand, could one day make roséchampagnes some of the best price performers around”, says Liv-ex.

The world's best Champagnes are in high demand. And the trade in its pink, exclusive equivalents is growing.

RareWine Invest's Opinion

The Magnum format is just a little bit cooler, but they also offer better ageing and cellaring potential, while they are produced in more limited quantities than the regular bottles, which together make them highly suitable for investment – and now the opportunity is there. The 2012 Cristal Rosé has already had a few years on the market and has since been followed by the 2013 vintage, and the 2014 Cristal Rosé is on its way.

The 2012 vintage has a long life ahead of it, and according to Juhlin, it should be enjoyed from 2025 at the earliest (assessed in a regular bottle). Wine Advocate agrees, and puts a drinking window of 2025-2065, also assessed on the basis of a regular bottle size.

Cristal Rosé has historically delivered a stable price performance, and if this 2012 delivers the same performance, it will pass. The most interesting aspect of this case, however, is the expectation that future demand for the exclusive pink bubbles cannot be extinguished by supply.

Cristal is one of the world's most sought-after Champagne brands, and the 2012 Cristal Rosé is among the very best.

Invest In 2012 Cristal Rosé On Magnum

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2012 | Cristal Rosé MAG | 1,500 | OC1 | € 1,150 |