Investment Tips - Burgundy - 15. December 2022

White Grand Cru Investment: Luxury Giant Bets on Bouchard

Top white wine comes from Burgundy. Period. And if you believe in their future, you can do as a French luxury giant and invest in Bouchard and Corton-Charlemagne

Bouchard: Not The Typical Burgundy Producer

Burgundy history is generally rich and long, yet some roots just stick deeper than others. One of the oldest is the story of Bouchard Pere & Fils (Bouchard & Sons), which dates to 1731, when Michel Bouchard laid the foundations for what would become one of the Cote d'Or's greatest vineyard owners.

While historically Burgundy has not had as much money in circulation as Bordeaux and Champagne, for example, even today Burgundy producers are often seen working under and belonging to modest and humble circumstances. Bouchard, on the other hand, housed at Chateau de Beaune - a 17th century royal fortress that Bouchard has owned since 1820. The cellars beneath the chateau provide Bouchard with optimal conditions for storing wine, and they are also famous for an outstanding collection of up to 2,000 bottles of wine from the 19th century, including a Meursault "Charmes" from 1846!

For almost 270 years, Bouchard Pere & Fils was in family hands until the Henriot family bought the company in 1995. If the Henriot name rings a bell, it is for good reason. Henriot has been growing and producing Champagne for more than two centuries, and it is one of the very few Champagne houses that has remained independent and family-owned throughout this period - until very recently.

Bouchard is thus part of a dynasty under Maisons & Domaines Henriot that includes Champagne Henriot, Bouchard Pere & Fils, Domaine William Fevre (the largest Grand Cru landowner in Chablis) and Beaux Freres (an American winemaker located in Oregon).

Bouchard can thus not be described as the typical Burgundy producer from humble origins. A unique heritage was built up over centuries until the already strong producer was reinforced by Henriot, which resulted in a brand-new winery in 2005.

Bouchard is thus in every way a major player, producing both cheaper wines and top wines from for example Corton-Charlemagne and Montrachet. They have the capacity and will to succeed in presenting and marketing great products.

Luxury Giant Acquires Majority Stake in Henriot

In September, it was revealed that the French private equity and luxury giant Artémis had acquired a majority stake in Maisons & Domaines Henriot, adding Henriot, Bouchard and Fevre to a portfolio that includes Chateau Latour and Clos de Tart.

Heritage and soul are expected to be assured as Gilles de Larouziére (a member of the Henriot family and former CEO of the group) will assist in the management of production across the various houses and domains.

In other words, everything is expected to continue on the same good path only with the addition of capital and know-how from Artémis. Artémis is making this acquisition for one reason and one purpose only: Artémis sees growth and development potential in Henriot, including Bouchard, with the aim of raising profits and keeping shareholders happy. A wave that you as a wine investor have the opportunity to ride.

Production of the World' s Best White Wines

There is a general consensus that only good (read: the best) white wine is produced in Burgundy. Of course, plenty of white wine is produced all over the world, but if we talk about the fine & rare segment, Burgundy is almost exclusively among the best. Bordeaux is not exactly known for white wine. Italy is not either. Napa's Screaming Eagle makes an almost unobtainable Sauvignon Blanc. And that is almost it. There is a lot of ok white wine in the world, but the best - it comes from Burgundy.

At the same time, the best is also in extremely limited production. There are 1.5-2 million bottles of grand cru wine produced annually in Burgundy (which is negligible in contrast to the roughly 100 million bottles produced in Burgundy in total, or 3.3 billion bottles from all of France). The majority of the 1.5-2 million is red, so the smallest percentage is of course white.

Of this, Bouchard produces Corton-Charlemagne from a 3.65 ha parcel that MAY yield a maximum of 23,360 bottles per vintage. So, this is a sought-after product in extremely limited supply.

The Biggest White Wine Brands

Among the best producers of white Burgundy and thus white wine in general, one cannot avoid Domaine Leflaive, Domaine Raveneau, Domaine Coche-Dury and Domaine d'Auvennay etc., but if the heritage sites of the best are also to be identified, two appellations are in play: Montrachet and Corton-Charlemange.

Here you have the opportunity to invest in Corton-Charlemagne from Bouchard, which along with names like Coche-Dury, Drouhin, Leroy and Roumier help to maintain one of the world's two greatest white wine brands.

Bouchard is priced in the mid-range with the likes of Drouhin and Faiveley, with their Corton-Charlemagne 2017, 2018 and 2019 vintages costing in the region of € 165-200 per bottle*.

At the top of the hierarchy we find Coche-Dury and Leroy. Coche-Dury's Corton-Charlemagne costs over € 6,000 per bottle*, while a similar one from Leroy easily costs twice as much.

This is a testament to the potential among the great white Burgundies, and prices seem uncapped just like their red counterparts.

*Free of duty, VAT and tax, in whole boxes and perfect condition

Invest Regardless Of Vintage

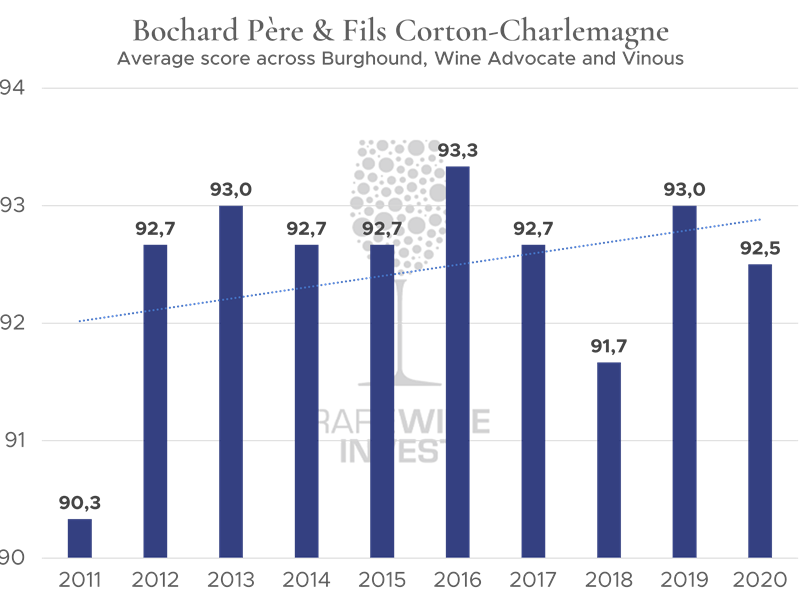

Over the past 10 released vintages of Bouchard's Corton-Charlemagne, there has been a steady high level, tending to slightly rise, as the trend line below testifies.

We have sourced a small quantity of 2016, 2017, 2018 and 2019 vintages respectively, which differentiate slightly in the average score, which is also reflected in the price. The weakest vintage, is compensated with a lower price.

The point of the above is simple: the recommendation does not consist in a specific vintage of Bouchard's Corton-Charlemagne. Rather, it is a recommendation of Bouchard as part of the white Burgundy case.

As mentioned, white Grand Cru from Burgundy is produced on a smaller scale than red. At the same time, white Burgundy has had some spectacular vintages in recent years that contribute positively to the overall case:

Vintage 2019 was a great vintage in Burgundy for white as well as red. 2020 is forecast on par with 2014 and 2017, generally considered top vintages for white Burgundy (as when talking 2015 for reds). 2021 was challenging, as we have previously discussed in this article. Frost and hail have reduced yields significantly (50-80% in some areas) with the result that some producers are planning not to release any Premier and Grand Crus wines from the vintage at all. In other words, overall supply has been down while quality is good. This is clearly an attractive environment for investment in white Burgundy in particular.

+11 % In Average Annual Return

Liv-ex validates investment potential with fine returns on Bouchard's Corton-Charlemagne. The last 10 vintages*, which have been on the market for at least five years, have produced an average return of 69.4 % over the last five years, equivalent to 11.1 % per year. What is interesting here is that the quality of the wines from before 2010 is generally not on a par with those after, while the Wine Advocate has not assessed them equally systematically either. Despite this, these wines have still performed well in terms of returns. What may be even more interesting is that, in the broad perspective, the white Burgundies have not seen the same explosive price increases as their red counterparts. The price increases of Bouchard's Corton-Charlemagne, for example, have been more linear in nature.

*2006-2015

RareWine Invests Opinion

The red Burgundy wines suitable for investment are generally rare, but if the colour is white instead, this is even more pronounced.

The world's best white wines come from Burgundy, demand is steadily increasing, while production is even more sparse than for the best red wines.

Bouchard Pere & Fils is a producer capable of great operation with wines in all classifications, the crown jewels being undoubtedly Montrachet and Corton-Charlemagne. Here you have the opportunity to invest in three new vintages of Corton-Charlemagne Grand Cru, which in terms of quality and brand belong to the top of the Burgundy hierarchy - and thus the world's wine hierarchy.

Basically, all the conditions for a classic Burgundy investment case are met, but Bouchard delivers more than that. Henriot initially acted as a launchpad, but Artémis' takeover of the Henriot dynasty has created even more lucrative prospects for Bouchard.

If you believe in investing in white wine, Burgundy, and Grand Cru, and if you believe that Artémis aims to maximise profits, then Bouchard's Corton-Charlemagne is an optimal investment for you.

Invest in Bouchard Pere & Fils Corton-Charlemagne Blanc

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2016 | Bouchard Pere & Fils Corton-Charlemagne Blanc | 750 | OC6 | € 175 |

| 2017 | Bouchard Pere & Fils Corton-Charlemagne Blanc | 750 | OC6 | € 175 |

| 2018 | Bouchard Pere & Fils Corton-Charlemagne Blanc | 750 | OC6 | € 165 |

| 2019 | Bouchard Pere & Fils Corton-Charlemagne Blanc | 750 | OC6 | € 175 |