Market Analysis - Italy - 16. December 2022

Investing In Italian Wine: What Does The Future Hold?

Italian wines are gaining popularity. But what does the future hold for the best Italian wines from an investment perspective? Read the analysis...

What Will Be The Future Of Investment In Italian Wine?

Italian wines are working their way into the global scene of rare and exclusive wines. One of the fundamental reasons for this is that the quality of the best Italian wines, in general, has increased significantly over the past 20 years. At the same time, these wines are priced extremely low in comparison with their French counterparts. This in itself is not news. But the wine world is starting to wake up to it, and the leading Italian producers are ready to be global wine brands - they have everything it takes, and then they have extraordinary wines.

The above creates excellent opportunities for wine investors in the coming years, and it is undoubtedly one of the reasons why we removed Italy from the "Rest of the World" category approximately two years ago. Italian wine is now at a stage where the numbers justify increased attention, which has led us to increase our recommended exposure to Italian wine in particular.

But what does the future look like for Italian wine? There is uncertainty and anxiety in the financial markets, so perhaps Italian wine can be safe heaven and the right place for returns if the downturn takes hold in the global economy. Find out for yourself below, where you will get an insight into luxury goods sales in uncertain times and how Italian wine has fared in times of crisis.

Also, read the champagne analysis: Analysis: The Prospects In Champagne - Will The Corks Pop In The Future?

Luxury Goods Sales In Times Of Crisis

Investing in luxury goods can seem counterintuitive with geopolitical and economic turbulence in the world markets. After all, if the crisis hits, the economy stalls and people become poorer; surely no one will buy (and, for wine and spirits, consume) luxury goods and thus help drive up prices. But is that really the case?

According to Milton Pedraza, CEO of the Luxury Institute (a company specializing in market analysis), luxury brands are often isolated from economic downturns1. The Pareto principle, also known as the 80/20 rule, applies here. Pedraza estimates luxury companies will feel an economic downturn as 80 % of their customers are "nearly affluent" or partially wealthy. Still, this group accounts for the smallest share of sales. On the contrary, the largest share of these companies' revenues is generated from about 20 % of their customers - the "very rich" and the "ultra-rich," two highly crisis-resistant groups. Therefore, crises and economic downturns rarely hit luxury companies as hard as other players. For example, it does not take much searching in the international media to find that low-cost chains such as Walmart, Gap, and Target are reporting falling sales. In contrast, LVMH, for example, reported organic sales growth of +21 % in the first half of 2022 compared to the previous year2, while Hermes International (another luxury mastodon) was able to report 24 % growth in October2, compared to 2021, which was already a strong year.

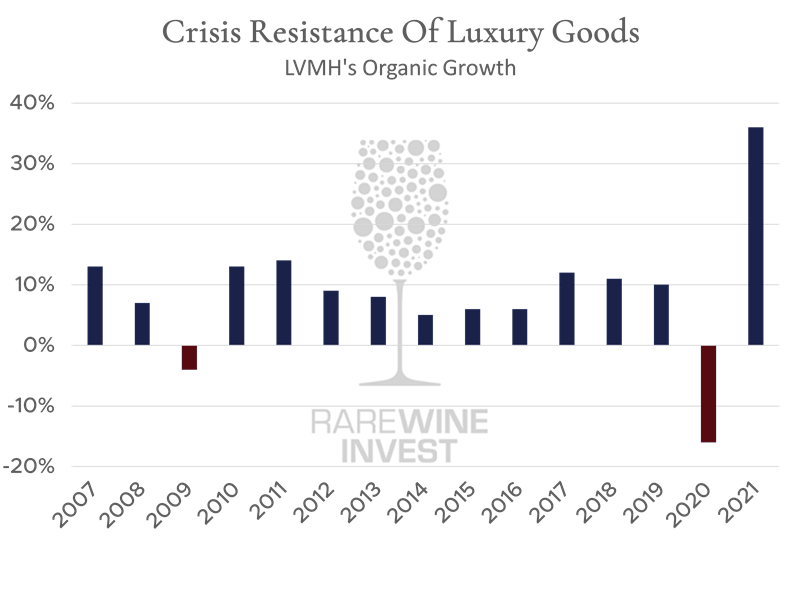

A good picture of the above is provided by a look at the organic year-on-year growth of LVMH, by far the luxury category's market leader: While LVMH is not behind any Italian wine producers, it is still seen as a good indicator that the best products in their category are in demand, even when the global economy is under pressure.

Source: Bloomberg, LVMH Annual Reports

Source: Bloomberg, LVMH Annual Reports

The strongest buyers are resistant but not immune to economic downturns, and so is LVMH. That said, the crises do not seem to hit hard. The financial crisis produced negative growth of a modest 4 %, and LVMH bounced back strongly the very next year. However, the Corona crisis hit the LVMH group harder, partly due to shutdowns which alone reduced the group's sales of wines and spirits by 15 %3. But what a rebound.

At the same time, it is relevant to look at the challenges markets are facing. For the Western world economy, inflation is the big headline. In the US, it is driven by demand and employment rate that is not easily shaken. In Europe, it is basically driven by the energy crisis and a troubled neighbourhood to the east. The only question is whether sales of luxury goods will be hit hard if we face an economic downturn. The above does not exactly suggest so.

3:https://www.lvmh.com/investors/profile/financial-indicators/#groupe

Lipstick Index & 'Affordable Luxury'

It does not seem evident that cosmetics manufacturers are the originators of the definition of economic indicators. But Leonard Lauder, a board member and heir to cosmetics giant Estée Lauder, has done precisely that.

During the 2001 recession, Leonard Lauder noticed that sales of luxury cosmetics, including lipstick, were increasing. He saw a link between falling sales of more expensive luxury products such as bags and stilettos and then rising sales of luxury cosmetics - and the "lipstick index" was born.

The index has since become a respected indicator and has proven that consumers tend to treat themselves to a bit of luxury - even in hard times*. And while the 20% of consumers from the previous section don't deviate much from their spending patterns, the evidence suggests that the 80% are more likely to be looking for so-called "affordable luxury."

But can this be put into perspective for the wine world? Probably. In the world of fine and rare wines, we can rightly call the great wines of Burgundy and Bordeaux, for example, luxury products, whereas the Italian wines - without stepping on anyone's toes - can well be called "affordable luxury" in this perspective. Some buyers will look for cheaper alternatives if the most expensive wines become unattainable.

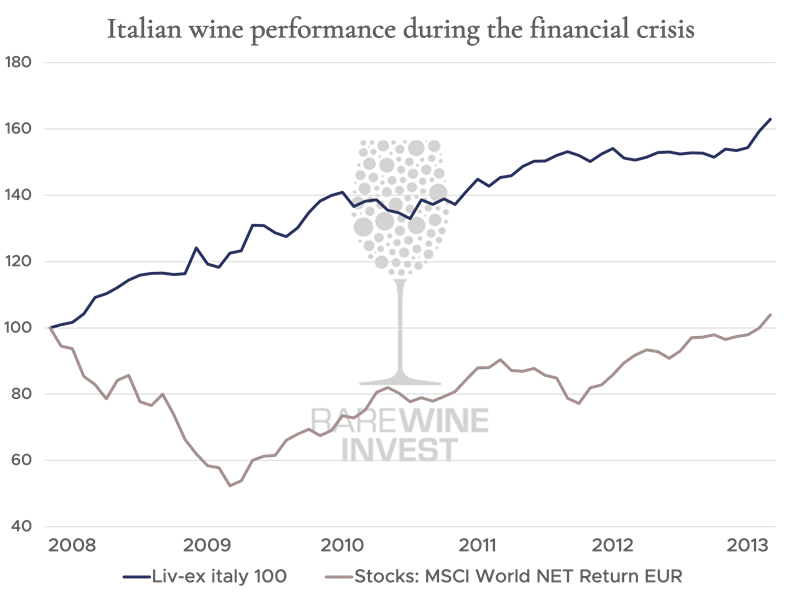

Italian Wine Has Performed Outstandingly In Times Of Crisis

Faced with an economic crisis, Italian wine can be attractive to be exposed to. During the financial crisis, the Liv-ex index Italy 100, today's broadest way to track Italian performance from a historical perspective, performed brilliantly. While from November 2007 to April 2009, the stock market almost halved3 and only achieved full recovery in spring 2013, Italy 100 rose by 62.9%, corresponding to an average annual return of as much as 11.9% during this period. A return that significantly outperformed the broad Liv-ex Fine Wine 1000 index and even outperformed the Champagne 50.

1: Based on MSCI World, NET Return, EUR

Source: Liv-ex

Source: Liv-ex

As The Classic Regions Slowed Down, Italian Wine Continued Unabated

Not only during the financial crisis were Italian wines on the rise. 2018 saw a record year for wine investors, who, thanks in part to Burgundy, delivered their best results in eight years. But on top of solid performance, it's not unusual for performance to slow down and take a breather - whatever the asset. This also happened in the wine market: Burgundy took the tailwind of 2018 into the beginning of 2019 and settled a bit, while Champagne also took a rest. The broad Liv-ex Fine Wine 1000 index thus delivered zero growth in 2019. For Italian wine in the form of the Liv-ex Italy 100 index, however, the story was different: in a world marked by the trade war between the US and the EU*, unrest in Hong Kong (the hub of the wine trade in Southeast Asia), Brexit turmoil, and not least that global Covid lockdown starting in the first half of 2020, the Italy 100 rose by 11.2% in a steady and almost linear movement. This, mind you, is in a world filled with turmoil of historic proportions.

The reason for this development may well be found in some of the preceding paragraphs. While the expensive became even more expensive during 2018, good Italian wines could become an attractive alternative for many, shifting demand from French wines to Italy. As the consequences of Covid-19 took hold in earnest in early 2020, and the stock market fell by around 20%, the mechanism of "affordable luxury" may well have kicked in among many wine lovers.

Source: Liv-ex

Source: Liv-ex

*It is relevant to remember that the trade war between the US and the EU triggered US punitive tariffs on European wine, except for Italian wine. This is significant but not considered the only driver of developments over the period. For example, French wine continued to be imported and consumed in the US during this period, while sales of American wine also flourished in the US during this period.

RareWine Invest’s Opinion

With all of the above in mind, it's hard not to be optimistic on behalf of Italian wines, whether we end up in a global recession or the challenges of inflation end in a soft landing. From this perspective, Italian wine has historically proven to be crisis resistant, but not just as a capital preservation asset but as a rewarding investment in difficult times.

If you wear the negative glasses, this is not generally where prices tend to explode, as we see in Burgundy, for example. However, this can also be seen as a strength, as prices have tended to develop nicely, generating steady returns and providing a solid component of risk diversification.

But what makes Italian wine most exciting is the future. Because as said at the beginning of the analysis: Italian wines are priced extremely low if we compare them with their French counterparts. That was the case 10 years ago and is still the case today.

Moreover, these years we are experiencing some of the best vintages in history from both Piedmont and Tuscany, exemplified by both Barolo and Barbaresco as well as Brunello, Chianti, and the so-called Super Tuscans. In short - Italian wine is experiencing a resurgence of dimensions, and new generations of talented winemakers are emerging, mapping vineyards and international attention like never before - right now is 'The Golden Hour' for Italian wine...