Investment Tips - Burgundy - 12. October 2022

Faiveley Is The Best Buy At Clos De Beze Right Now

The right name for both producer and vineyard. High quality and limited production. Here is the opportunity to invest in one of Faiveley's top wines

If Burgundy is said, it is hard to avoid Gevrey-Chambertin. Partly because eminent wines generally emerge from this commune, but also in particular because the commune's nine prestigious Grand Cru vineyards attract the attention of wine connoisseurs. The two most prominent are Chambertin and Chambertin-Clos de Beze, the latter of which you now have the opportunity to invest in. Even from a producer who is by no means under the radar, but right now offers attractive potential in terms of price, quality, and maturation potential in the very Clos de Beze.

Seven Generations Are Forming Burgundy

For seven generations the Faiveley family has owned and operated Domaine Faiveley, and for just as long they have left an important mark on Burgundy as we know it today.

Domaine Faiveley is today among Burgundy's largest landowners and producers with about 120 hectares of vineyards and an annual production of around 400,000 bottles. But having said that, Domaine Faiveley represents far from industrialized and heartless mass production. In fact, in addition to a wide range of Village and Premier Cru wines, Faiveley produces 13 different Grand Cru wines from some of the best vineyards in the world. For example, Faiveley is particularly known for their Musigny, which easily costs more than €3,000 per bottle* in better vintages, but also until the 2014 vintage was known as Burgundy's smallest cuvée with a production of just around 170 bottles per vintage. From the 2015 vintage, however, this was raised to around 500 bottles per vintage, as the domaine almost miraculously managed to gain ownership of another parcel in the vineyard.

Another of the domaine's top wines (and perhaps only surpassed by Musigny?), Chambertin-Clos de Beze, is another example of the house's will and aility with small productions in the Burgundian spirit: Here, from a scarcely 1.29-hectare parcel, around 6,000 bottles are produced per vintage. A wine that right now offers the wine investor the opportunity to invest in one of the world's most famous Burgundy Grand Cru's under lucrative conditions.

Domaine Faiveley is an inevitable institution in Burgundy, and thanks to a product portfolio that is well represented on the whole scale of Burgundian wine, this is a producer with a huge audience, and at the same time they have the capacity and know-how to continue developing both brand and quality - arguably for the next seven generations as well.

*Excluding customs duties, VAT, and taxes.

"This is a remarkable wine in every sense […]. This too is going to require seriously extended cellaring."

- Burghound, 2014 Faiveley Clos de Beze

Price Development

Domaine Faiveley produces without doubt exceptional wines that impress in each of their categories and classifications. Chambertin-Clos de Beze belongs to the top and has historically guaranteed solid returns - even if critics testify that these need a very long time to reach their potential.

According to Liv-ex, the last 10 vintages* of Faiveley's Clos de Beze, which have been on the market for a minimum of five years, have over the last five years yielded an average of 52%. This corresponds to an average annual return of 8.7%.

You now have the opportunity to invest in both the 2012 and 2014 vintages of Faiveley Clos de Beze, and in the above equation, these two are actually some of the vintages that pull the down average. The 2012 vintage is reported to be up 31%, while the 2014 vintage is up 23%. This is not surprising, however: It simply underlines that the potential for these wines is even greater in the long run.

It can thus be excluded that the lower price increases on the younger vintages are due to lower quality. Among the last 20 vintages**, the 2012 vintage is surpassed only five times, while the 2014 vintage is surpassed only three times. And here, the margins are being counted:

| Vintage | BH | WA | VI | AVG |

|---|---|---|---|---|

| 2020 | 94,5 | 96 | 96 | 95,50 |

| 2019 | 94,5 | 95 | 95 | 94,83 |

| 2014 | 94,5 | 96 | 94 | 94,83 |

| 2012 | 94,5 | - | 95 | 94,75 |

| 2010 | 95,5 | - | 96 | 95,75 |

| 2005 | 96 | - | 94 | 95,00 |

There is no doubt that the prices of these wines have increased, but they still seem too cheap - in particular the 2014 and 2012 vintages.

* Vintage 2006-2015, **Vintage 2001-2020

"Stunning - but it is unquestionably built for the long-term."

- Wine Advocate, 2014 Faiveley Clos de Beze

Faiveley In Clos De Beze Perspective - Here Is Super-Value For Money

Faiveley's Clos de Beze carries in itself a solid potential in terms of name, quality and not least the scarce production. But if we take a closer look at Chambertin-Clos de Beze, this is only reinforced.

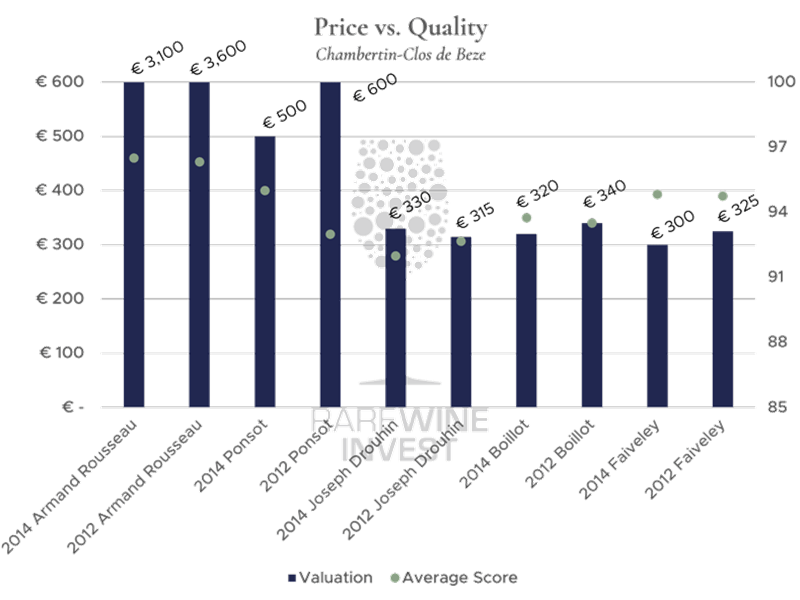

Clos de Beze measures approximately 14.5 hectares, which are divided between a wide range of more or less famous producers. Zooming in on some of the vineyard's more prominent producers, you will find that an attractive price/quality ratio exists from Faiveley:

Note: Scores are averages of Wine Advocate, Vinous and Burghound scores. Individual scores are missing for some vintages.

Note: Scores are averages of Wine Advocate, Vinous and Burghound scores. Individual scores are missing for some vintages.

Armand Rousseau not surprisingly stands at the top of Chambertin-Clos de Beze* and presents wine of sublime quality but also with an impressive price tag. Domaine Ponsot performs in the 2012 and 2014 vintages about as well as Faiveley, but also at a significantly higher price. Joseph Drouhin and Boillot have received lower scores from critics on average in both these vintages - on the other hand the price is higher, or at best about the same.

The numbers speak for themselves, and they testify that Faiveley's 2012 and 2014 Clos de Beze are attractive buys.

*It should be mentioned that Domaine Dujac also produces from Clos de Beze but blends their wine with the wine from Chambertin and bottles it under the name Chambertin, which is why it is not included here.

"A complete young grand cru Burgundy"

- Vinous, 2012 Faiveley Clos de Beze

RareWine Invest's Opinion

Domaine Faiveley is an impressive domaine, mastering both the Village in large productions and the micro productions from the absolute top - which besides the impressive land holdings has made the domaine what it is today.

We have the right name here - both producer and vineyard, the quality is undeniable and the production quite limited - especially considering the price level, where extremely many can participate. And while the historical returns also validate the potential, it is when price and quality are compared to the other prominent producers at Clos de Beze that the potential seems clear: the 2012 and 2014 Faiveley Clos de Beze simply look like the best value-for-money buy among the top producers at Clos de Beze right now.

But which vintage should you choose?

Qualitatively, the two vintages are as comparable as anything can be:

| Vintage | BH | WA | VI | AVG |

|---|---|---|---|---|

| 2014 | 94,5 | 96 | 94 | 94,83 |

| 2012 | 94,5 | - | 95 | 94,75 |

Subtracting the Wine Advocates score on the 2014 vintage, the average here is 94.25.

Similarly, no evidence was found of above- or below-average production in these two vintages.

The 2012 vintage adds a little age, but also at a slightly higher price. So, whether to choose one over the other is a matter of temperament.

But of course, you can cover yourself and secure investment in both vintages. The potential of both is undeniable.

Invest In 2012 And 2014 Domaine Faivaley Chambertin-Clos De Beze

Contact us via the contact form at the bottom of the page if you want to know more about your investment options or order the wines directly through the form.

| VINTAGE | WINE | VOL | PACKING | PRICE/BTL.* |

|---|---|---|---|---|

| 2012 | Domaine Faivaley Chambertin-Clos de Beze | 750 | OWC6 | € 325 |

| 2014 | Domaine Faivaley Chambertin-Clos de Beze | 750 | OWC6 | € 300 |