Investment Tips - Champagne - 23. September 2020

How long time before the prestigecuvée Nicolas Francois from Billecart-Salmon becomes as expensive as Krug Vintage?

You now have the opportunity to invest in 2006 Nicolas Francois - one of the best vintages ever and with an attractive but unsustainable price-quality ratio…

Richard Juhlin: "Make sure you buy wines from Billecart-Salmon before they become as expensive as Krug!"

In recent years, Billecart-Salmon has truly been recognized as the luxury house it is. This kind of fine and elegant Champagne is the style asked for when we see the New-Nordic cuisine triumph across the board. This perfect food and wine match has increased the interest in both Billecart-Salmon and especially their best wines.

As a result of this, Cuvée Nicolas Francois has simply become an even more interesting topic when it comes to investing. Right now, you have the opportunity to acquire this Champagne at a price that seems significantly lower than the quality should dictate it. In fact, the 2006 vintage of Billecart-Salmon's prestige cuvée, which this investment tip is about, is among the best that the house has ever released and if you believe the champagne guru Richard Juhlin, it is only a matter of time before Nicolas Francois becomes as expensive as the icon. Krug Vintage.

Look closer at the investment tip and learn more about the investment potential in 2006 Billecart-Salmon Nicolas Francois and assess whether you also believe that this will be a shooting star.

The prestige cuvée 2006 Nicolas Francois is now available for investment

The prestige cuvée 2006 Nicolas Francois is now available for investment

Family Owned Through Generations

The more than 200-year-old champagne house is jointly run by 6th and 7th generation today. Billecart-Salmon is one of the few large champagne houses that is still owned and operated by the founding family. Something that gradually becomes rarer, but perhaps can be read in the pertinence and honor that is put into the wines. The house is in Mareuil-sur-Aÿ which is classified as a grand cru village. The majority of the house's grapes come from its own vineyards here, while smaller quantities come from long-term contracts in other grand cru villages such as Avize, Cramant and Le Mesnil. The combination of grapes in vintage 2006 is 60% pinot noir and 40% chardonnay.

2006 Nicolas Francois is the latest release of the house's prestigious cuvée, and with the 97 points from Vinous it puts it in distinguished company with Dom Pérignon (96p Vinous), Cristal (96p Vinous), Dom Ruinart (97p Vinous) and Salon (96p Vinous) - but this is just a simple argument that illustrates what we are really dealing with here.

Great Untapped Potential For 2006 Nicolas Francois

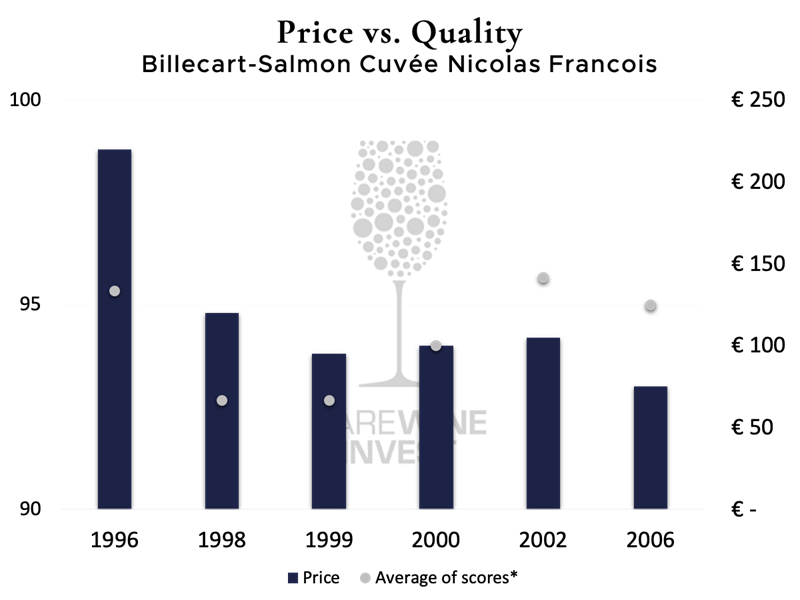

If you compare the 2006 vintage to alle vintages from the last 20 years, then you will notice that the 2006 vintage is exclusively surpassed by the two top vintages 1996 and 2002 - and not by far. Vintage 2006 has 95 points on average from the three most important champagne critics*, while vintage 2002 gets 95.6 and 1996 gets 95.3. In other words, 2006 Nicolas Francois is one of the greatest champagnes Billecart-Salmon has ever produced.

At the same time, the relationship between price and quality in both the year 2002 and 2006 seems to be completely off-beat, with the year 2006 currently resembling a bargain. The price of the 2006 vintage by Cuvée Nicolas Francois is still at a significantly lower level than directly comparable vintages, which can be seen in the chart below. The three best vintages; 1996, 2002 and 2006, for Cuvée Nicolas Francois, all are assessed at a minimum of 95 points on average, which is categorized as "outstanding".

What makes this really interesting from an investment perspective is that the year 2006 can be acquired for a third of the price of 1996 and approx.. € 30 cheaper than 2002. With the above in mind, there seems to be a large untapped potential in the 2006 Vintage of this wine. Assess yourself in the diagram below.

*Richard Juhlin, Wine Advocate and Vinous

*Average of scores from Richard Juhlin, Wine Advocate og Vinous

*Average of scores from Richard Juhlin, Wine Advocate og Vinous

Historical Returns Validate The Investment Potential

When looking at the last five vintages, that has all been on the market for more than five years(2002, 2000, 1999, 1998, 1996), they have given a return of more than 45%, average annual return of 7.77%*. This should primarily be seen as a validation of the investment potential. The really interesting thing here is that there are many indications that Billecart-Salmon and Nicolas Francois are entering a new era, which indicates that the large price increases will continue in the future. At the same time, a solid return over the past five years validates the case and investment in Nicolas Francois in general and the year 2006 in particular, seems to be really interesting right now.

*Based on trading data from Liv-ex. The trading volume and thus the amount of data is here a bit lower than we normally report on, which is why these figures should be read in more detail as indicative.

The characteristic label of Cuvée Nicolas Francois

The characteristic label of Cuvée Nicolas Francois

Same Quality As Krug, But A Completely Different Price!

In addition to the untapped potential of 2006 Nicolas Francois, it is also interesting to compare the quality with some of the other top champagnes, and inspired by Richard Juhlin, it is obvious to look at what is considered by many to be the world's best champagne house, Krug. If you compare the 2006 vintage by Nicolas Francois with the 2006 Krug Vintage, which also received 97 points from Vinous, it looks even more interesting with the untapped potential of the Cuvée Nicolas Francois. Krug Vintage currently costs around € 100 more. Krug is in many ways in a class of its own, but when the world's leading champagne critic dares to put Krug Vintage and Billecart-Salmon in the same booth, then you as a wine investor should listen.

RareWine Invest's Opinion

In many ways Nicolas Francois from Billecart-Salmon seem like a prestige cuvée on the upswing, both in terms of interest and reputation, but in particular also due to the quality that has been steadily increasing in recent years. This means that Nicolas Francois is generally a very interesting champagne case where the latest vintage, namely 2006, right now stands with what looks like an increased and not least untapped potential.

The vintage 2006 is among the absolute best editions of Nicolas Francois ever presented, surpassed only by the top years 2002 and 1996, but at the same time the price seems unsustainably low compared to the other years where, for example, 1996 is almost three times as expensive.

All indications points that Nicolas Francois is a prestigious cuvée that is on the rise and this is your opportunity to secure a strong and attractive vintage, at a particularly attractive price, and at the same time have the opportunity to gain volume in your investment.

And to end exactly where we started, all that remains is to repeat Richard Juhlin's words:

"Make Sure You Buy Wines From Billecart-Salmon Before They Become As Expensive As Krug!"

Invest In 2006 Billecart-Salmon Cuvée Nicolas Francois

Contact us by using the form below if you want to invest or learn more about your possibilities.

| Vintage | Wine | VOL. | Packing | Price* |

|---|---|---|---|---|

| 2006 | Cuvée Nicolas Francois | 750 | OC6 | € 75 |