Investment Tips - Champagne - 24. March 2020

Champagne, The Wine World’s Bond: Invest In 2012 Cristal At Bargain Price

Take advantage of a temporary oversupply and invest in a legendary champagne where the low price far from fits the towering quality - a bias that offers potential

Massive Quantities Of Luxury In Demand

The prestige cuvée Cristal from Louis Roederer is perhaps one of the most recognized premium champagne brands, on parallel to Dom Pérignon and perhaps Krug Vintage, although the latter do not quite share the category. We almost swear that all champagne lovers know Cristal and many have had the pleasure of drinking it through the last centurie - a pleasure that only varies with the vintage, but never disappoints.

Louis Roederer reportedly produces more than 3 million bottles of champagne a year, hundreds of thousands of which turn into their flagship champagne Cristal. On that point, Cristal is a massive production, but the huge output is solely to meet the enormous demand. And while the huge volumes seem endless, the stocks at the manufacturer are emptied prior to the next release and the cycle is then repeated. But the vast majority of champagne is drank young and it offers opportunities for the champagne investor who will in the future be able to offer perfectly ripe champagne of a vintage that was otherwise sold out long ago - and who would not like to drink a mature Cristal if the opportunity shows?

The 2012 Vintage: Great Quality At Even Greater Price

The 2012 vintage of Louis Roderer’s Cristal is the successor to the 2009 vintage, which must be considered more or less sold out from the producer and thus the 2012 vintage is the current vintage of Cristal.

The 2012 vintage has been well received by the critics who have so far agreed that this is an extremely strong vintage:

| Cristal | RJ | WA | VI | JS | Avg |

|---|---|---|---|---|---|

| 2012 | - | 97+ | 98 | 98 | 97,7 |

| 2009 | 96 | 95+ | 96 | 97 | 96 |

| 2008 | 97 | 98 | 99 | 100 | 98,5 |

| 2007 | 94 | 95 | 97+ | 96 | 95,5 |

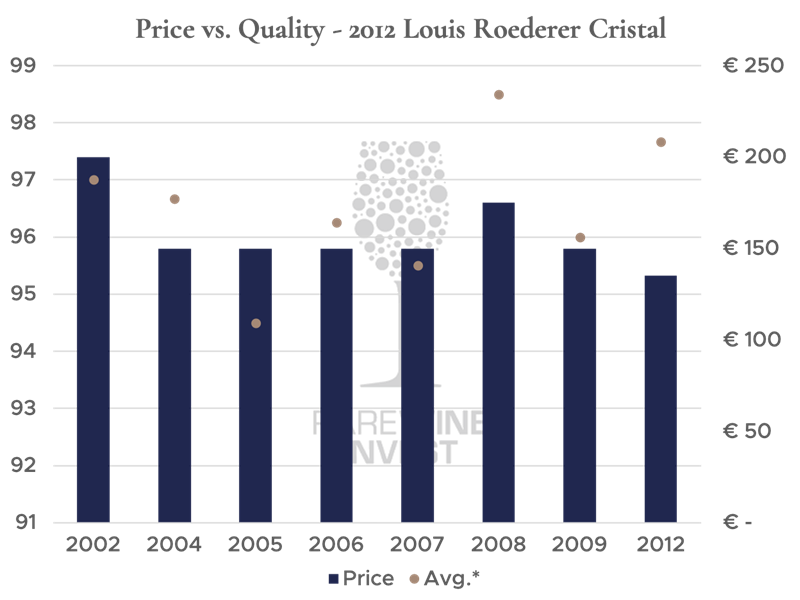

As seen in the table above, Richard Juhlin who has champagne as a specialty has not yet scored the 2012 Cristal. With champagne as a specialty, it must be expected that he is slightly more critical and pickier than his colleagues, which is also seen in previous vintages. If the other three scores are used as a guideline and from this point of view a conservative score from Juhlin is expected, it can safely be argued that Louis Roederer got the best out of their 2012 Cristal and delivered a very attractive champagne. If price and quality are compared, the 2012 vintage will only appear even more attractive from an investment perspective:

* Richard Juhlin has not yet given criticism on the 2012 Cristal why this rating is not included in the average. We may expect a conservative score which may drag down the average a bit

* Richard Juhlin has not yet given criticism on the 2012 Cristal why this rating is not included in the average. We may expect a conservative score which may drag down the average a bit

Apart from the fact that the 2012 vintage is of towering quality, the attractive price / quality ratio is due to the fact that the price of the 2012 vintage is very low right now. The current price can largely be attributed to the fact that the 2012 vintage was released in Q4 2019 and thus had a relatively short time on the market. This means that the manufacturer is sending a lot of Cristal to the market, which in combination with a market that has slowed down a bit during the Corona crisis, creates a temporary oversupply of 2012 Cristal. Therefore, the champagne investor here has the opportunity to buy large quantities of a high-quality Cristal vintage at a very attractive price.

Update 25 March 2020: Important Rating Revealed Since This Article’s Publication

As described above, the 2012 Cristal is a strong investment case, even without the decisive Richard Juhlins critisism. Even in a what-if-scenario where Richard Juhlin was to give particularly conservative criticism, the 2012 Cristal could compare with even the top vintage of 2002.

Following the investment tip's publication, a representative from Richard Juhlins Champagne Club has approached us and shared Juhlin's criticism and review of exactly Louis Roederer's 2012 Cristal, although it has not yet been published on their own platform - and the result is better than one could hope for and of sensational character!

Richard Juhlin is, to say the least, excited about the 2012 vintage and gives it a whopping 98 points. This means that the 2012 vintage’s average points end at 97.8 across the four main critics. This ranking means that the 2012 vintage is further distanced to the top 2002 vintage and strengthens the ranking as one of the best Cristal vintages ever, surpassed only by the legendary 2008 vintage*.

A close study of Richard Juhlin’s Cristal reviews makes it even more clear that the 2012 vintage is something very special: by the 98 points, the 2012 vintage surpasses the legendary vintages 2008 and 1988 and we have to go back to the 1979 vintage to find latest 98-point score from Juhlin, and all the way back to 1959 to find the latest vintage scoring 99 points.

The new review thus takes 2012 Cristal to a whole new level and contributes only further to the potential of what can now be called one of the greatest vintages of Cristal ever.

The scoring from Richard Juhlin and 2012 Cristal's status as one of the greatest Cristal can prove to be extremely important for the future potential returns. In the future, when the Cristal 2008 can no longer be purchased, or it simply become too expensive for some champagne lovers, the attention will surely be drawn towards the 2012 vintage as the next in line of the greatest - something that can seriously affect the price.

*The systematic ratings across all the critics is flawed in older vintages, so it is impossible to make the same methodical comparison on these as is the case with recent ones. However, the points and patterns cannot be mistaken.

Cristal in the characteristic clear bottle giving this champagne it's unique look

Cristal in the characteristic clear bottle giving this champagne it's unique look

Champagne – The Bond Of The Wine World

Champagne has historically delivered stable, ongoing returns. At the same time, this category is also subject to enormous ongoing consumption, which at a daily base contributes to reducing supply. At the same time, despite the demand for mature vintages, there is no particular tradition of storing champagne as we see it in other categories.

Historically, champagne prices have been less volatile, even when compared to, for example, Burgundy and Bordeaux, which can already be described as assets with a high degree of security and thus one can give champagne the nickname of the bond of the wine world.

Although a temporary oversupply today means highly investment-friendly prices, the supply will continuously be reduced and in normal circumstances this mean that prices can increase as the wine matures and the quality rises and the precious drops only become more sought after.

RareWine Invest’s Opinion

By their 2012 Cristal, Louis Roederer got the maximum out of the quality of the vintage and presented a great successor to the already legendary 2008 vintage at the end of 2019.

Although we still lack criticism from champagne guru Richard Juhlin, we can safely say that there is a broad consensus among the other top critics that the 2012 vintage is of extremely high quality, which among the past eight vintages is surpassed exclusively by the 2008 vintage and even by a very conservative rating by Juhlin, is comparable with the top vintage of 2002.

In addition to the general potential of one of the greatest premium champagne's towering quality, an oversupply in the market creates attractive conditions for the investor who can right now buy 2012 Cristal in large quantities at a very attractive price - a price that far from equals the champagne's high quality and is a bias we have often seen the market correct - and since the quality is as it is and critics only rarely adjust their scores downwards, there is only price rises to correct the skewed price-quality ratio.

At the same time, the champagne category has general terms some particularly interesting properties that, through a huge ongoing consumption and extremely limited storage tradition, make this category investable and in particular have strong capital preservation properties.

If you want to take advantage of the opportunity to purchase a very strong vintage of Cristal at a particularly attractive price and later offer champagne lovers of the world an opportunity to enjoy mature Cristal, this is an obvious opportunity that even comes with a high degree of security.

Invest in 2012 Cristal fra Louis Roederer

Contact by using the form below if you want to invest or learn more about your possibilities.

| Vintage | Wine | VOL. | Packing | PRIce |

|---|---|---|---|---|

| 2012 | Cristal | 750 | OC6 | € 135 |