Market Analysis - 28. January 2019

2018 was a Record-Breaking Year for Investments in Wine

With a 14.5% return, 2018 became the best year for investments in wine for 8 years, and wine has now provided investors with positive returns for over ten years in a row!

Wine Provided a 14.5% Return in 2018 - The Best for Eight Years!

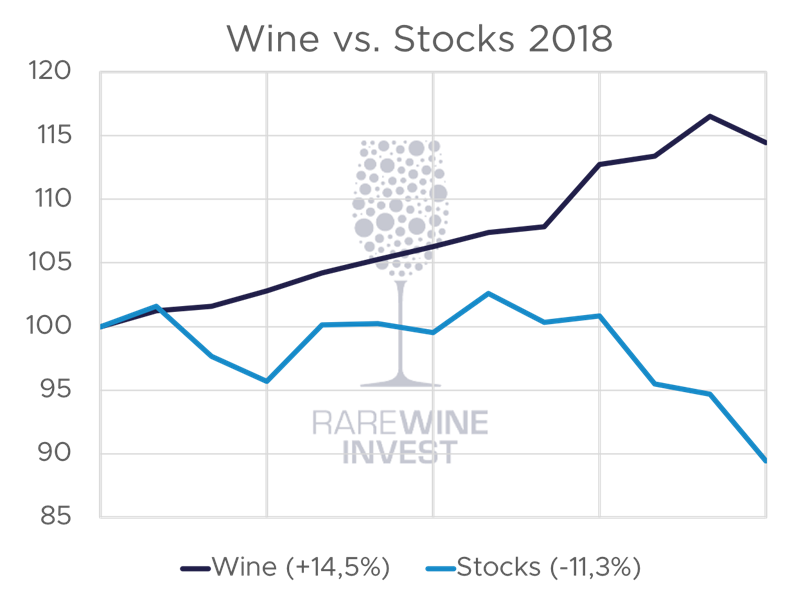

2018 has been an exciting year from an investment perspective, but an investor in stocks and an investor in wine will have two completely different stories to tell when asked about the return on their investment and the past year.

A growing interest in wine and increasing global prosperity have resulted in increased demand for the world’s most exclusive wines that led to a 14.5% rise in prices in 2018 for the benefit of investors in wine.

While the stock markets cycled up and down during the first three quarters of the year and ended up with the worst quarter in over seven years, the prices of wine remained stable and, yet again, demonstrated wine’s exclusive ability to provide positive returns and, at the same time, act as a protection against crises and corrections.

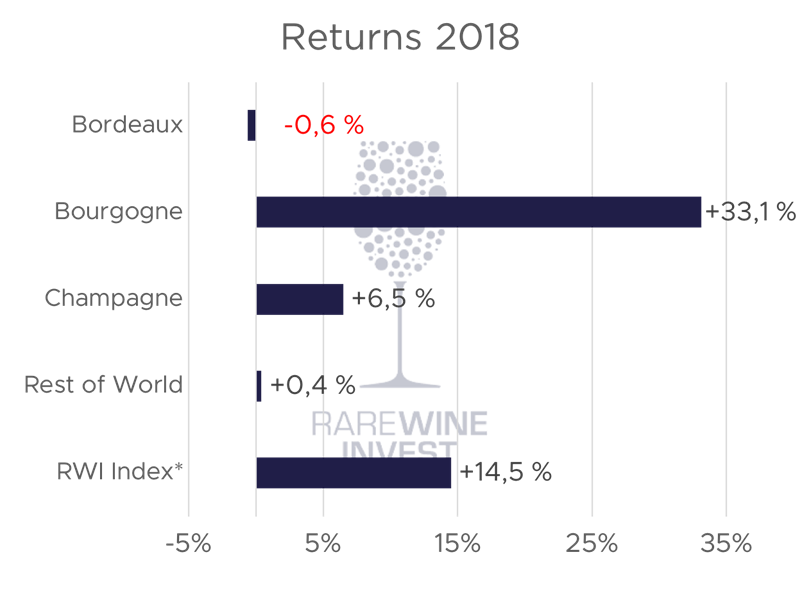

*An index composed of four Liv-ex indices: Bordeaux 500 (10%), Burgundy 150 (40%), Champagne 50 (30%) and Rest of World 50 (20%) rebalanced every month.

*An index composed of four Liv-ex indices: Bordeaux 500 (10%), Burgundy 150 (40%), Champagne 50 (30%) and Rest of World 50 (20%) rebalanced every month.

Wine Prices were Stable while Stocks were given a Bashing during the last Quarter of the Year

With a 12.8% return following the end of the first 9 months, 2018 could potentially have been the best year ever, seen from the investor’s point of view.

However, the story was somewhat different in a quarter where the stock market fell by 11.3% while wine prices increased by only 1.5% in the 4th quarter, resulting in a 14.5% return on investments in wine in 2018.

Wine: RWI Index: An index composed of four Liv-ex indices: Bordeaux 500 (10%), Burgundy 150 (40%), Champagne 50 (30%) and Rest of World 50 (20%) rebalanced every month. Stocks: MSCI Europe’s net total return converted to DKK.

Wine: RWI Index: An index composed of four Liv-ex indices: Bordeaux 500 (10%), Burgundy 150 (40%), Champagne 50 (30%) and Rest of World 50 (20%) rebalanced every month. Stocks: MSCI Europe’s net total return converted to DKK.

The Return on Wine is Twice as high as that on Stocks

A return on wine of all of 14.5% in 2018 combined with a terrible stocks year means that, over the last fifteen years, wine has been twice as good an investment as stocks.

In particular, from 2004-2018, wine has provided a return on investment of 240%, while the figure for stocks during the same period was 114%.

Wine is the safe Harbour in a Storm

Wine has historically been a strong asset in bad times and has proved to be so yet again in 2018. The same story could be told about 7 years ago where the stock market also lost more than 10% of its value during the course of a quarter, while the wine investor’s figures remained green.

In the 3rd quarter of 2011, the stock market lost 16.4% of its value, while wine prices correspondingly increased by 5.7%. Seven years later, in the 4th quarter of 2018, wine prices increased by 1.5%, while the stock market fell by 11.4% during the same period.

The last quarter of the year did not offer big profits, but rather a reminder that wine constantly maintains its price while the stock markets get a bashing.

The very ability to combine stable high returns with low risk means that wine should be included in any adequately diversified investment portfolio.

Trade War between the United States and China

Chinese growth has been decreasing steadily over many years, and the trade war between the United States and China has contributed to the Chinese growth in 2018 being the lowest since 1990.

While we were able to report on decreasing Chinese demand already in the 3rd quarter, without this having had any influence on wine prices, demand fell slightly in the 4th quarter. In particular, sales were adversely affected ahead of the Chinese New Year (5 February 2019) and could result in decreased Chinese demand during the 1st quarter of 2019 if it proves that Chinese wine traders have over-purchased and end up with greater than expected stocks after the new year.

The positive story is that the rest of the wine market has, to a large extent, taken over and proven to be particularly affluent. Thus, the price of wine has not fallen, and prices have instead either stagnated or increased.

Trade war

Trade war

Bourgogne has beaten everything and everyone (+33.1 %)

During the course of the year, we have seen a clear tendency for the price of the most expensive wines from the largest producers in Burgundy, to increase the most. The winners this year have been the top producers Armand Rousseau, Domaine de la Romanée-Conti, Domaine Leroy and Liger Belair while Emmanuel Rouget and the white wine producer Coche-Dury have delivered solid returns.

Bourgogne provided a return of 33.1% in 2018.

2008 Vintage Champagne affects the Balance - and Creates new Opportunities

During 2018, the 2008 vintages of both Cristal and Sir Winston Churchill were launched on the market and, while Dom Pérignon will not release their 2008 vintage until January 2019, we have already

seen that the market has welcomed their pre-released 2008 vintage Legacy Edition, that was launched in November and is being traded at record high prices.

The very release of the 2008 vintage at record high prices means that the secondary vintages appear to be relatively cheaper and the price of the 2006, 2007 and 2009 Cristal vintages has increased by 10% in both 3th and 4th quarter and they have all provided a return of over 20% in 2018.

Dom Pérignon’s secondary vintages have also increased in price ahead of the release of the 2008 vintage, and the 2006 and 2009 vintages have increased by 5% and 8% respectively in the 4th quarter.

Champagne provided a return of 6.5% in 2018.

Bordeaux is dormant and losing ground

Bordeaux is known as the classic wine investment. The market is relatively effective, and Bordeaux prices are, therefore, also those that most closely follow the market economy. The 3.0% price fall in the 4th quarter can also be assigned mainly to the rest of the economy and the falls on the stock markets.

As an investment, Bordeaux will be of decreasing interest and, except for the most expensive wines, such as Petrus and Le Pin and the older legendary wines from the 80s and earlier, Bordeaux wines have generally disappointed in 2018.

Bordeaux made a loss of 0.6% in 2018.

Italy and the United States offer themselves, but Whisky still Beats Wine

Wines from Tuscany have been very prominent in the media picture during the last few months and Wine Spectator’s recent selection of 2015 Sassicaia as wine of the year in 2018 has triggered enormous interest and prices rose by more than 25% overnight. Another prominent Italian news item was the release of Masseto’s 2015 vintage. The massive interest in Masseto can be said to reflect its status as Tuscany’s most expensive wine.

After a turbulent start to the year, American wine appears to be back on track and Dominus and Screaming Eagle from each end of the price range have both delivered returns of the order of 5-10% during the last quarter.

Whisky has during latter years delivered substantially better returns than wine and continues in 2018 to beat wine as an investment, and the returns on Whisky in 2018 were comparable with the returns on Burgundy.

Rest of World provided a 0.4% return in 2018.

*All prices are in EUR ex. customs duty, tax and VAT for delivery to a bonded warehouse. Prices including customs duty, tax and VAT can be sent on request. The wines are only sold in whole boxes unless otherwise specified and the price is per bottle. Requires a total minimum investment of EUR 10.000.